Energy Trend Tracker

Energy Trend Tracker has moved! Click here to visit the new site.

Recent developments and data that help track the trends on coal and renewable energy.

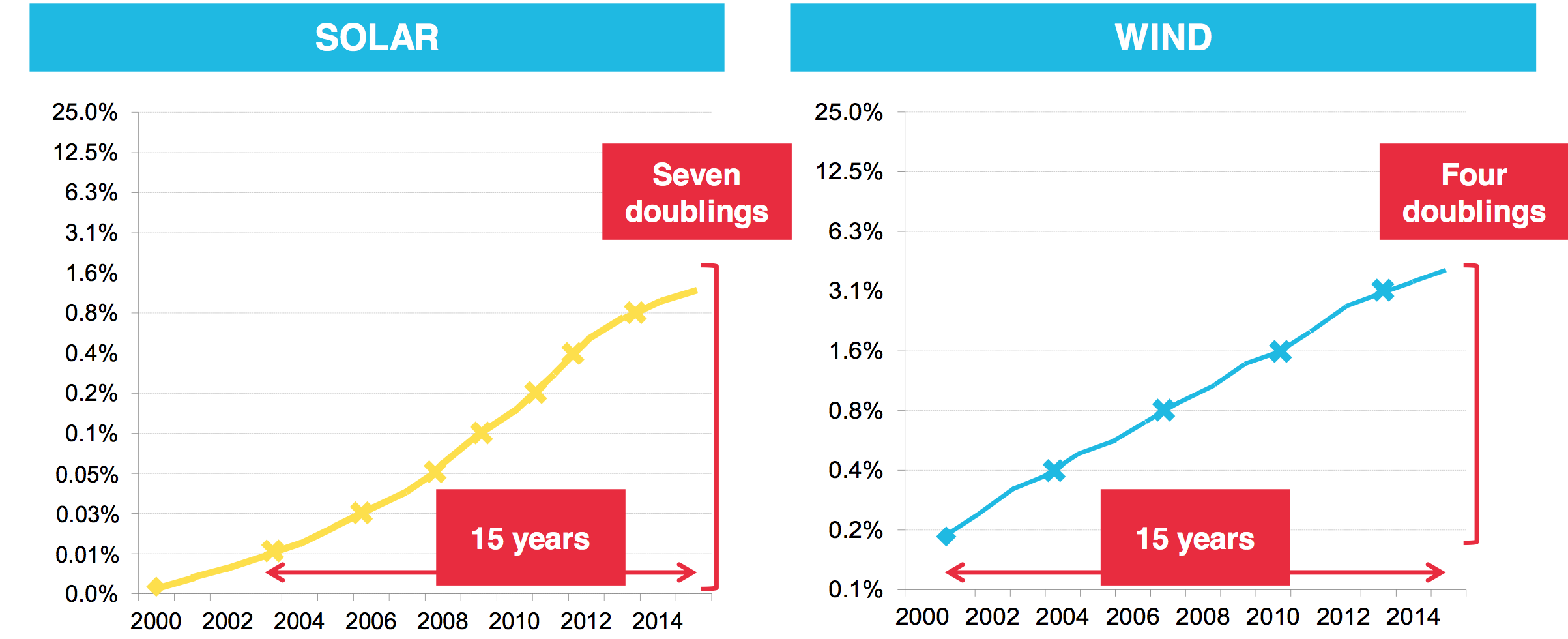

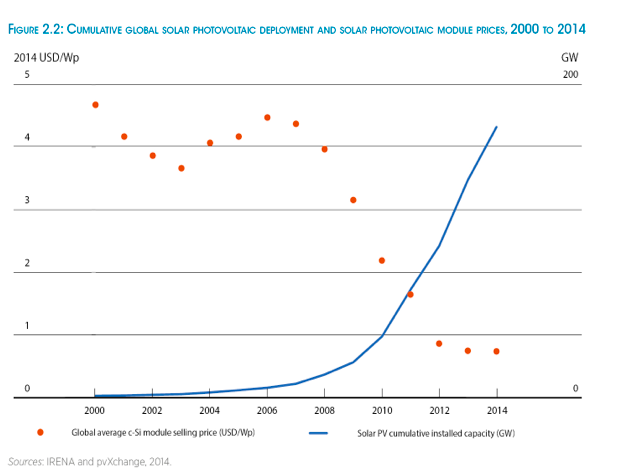

“Every time global wind power doubles, there’s a 19% drop in cost, and every time solar power doubles, costs fall 24%.”– From an analysis by Bloomberg New Energy Finance |

A growing faction of the GOP is bullish on clean energy

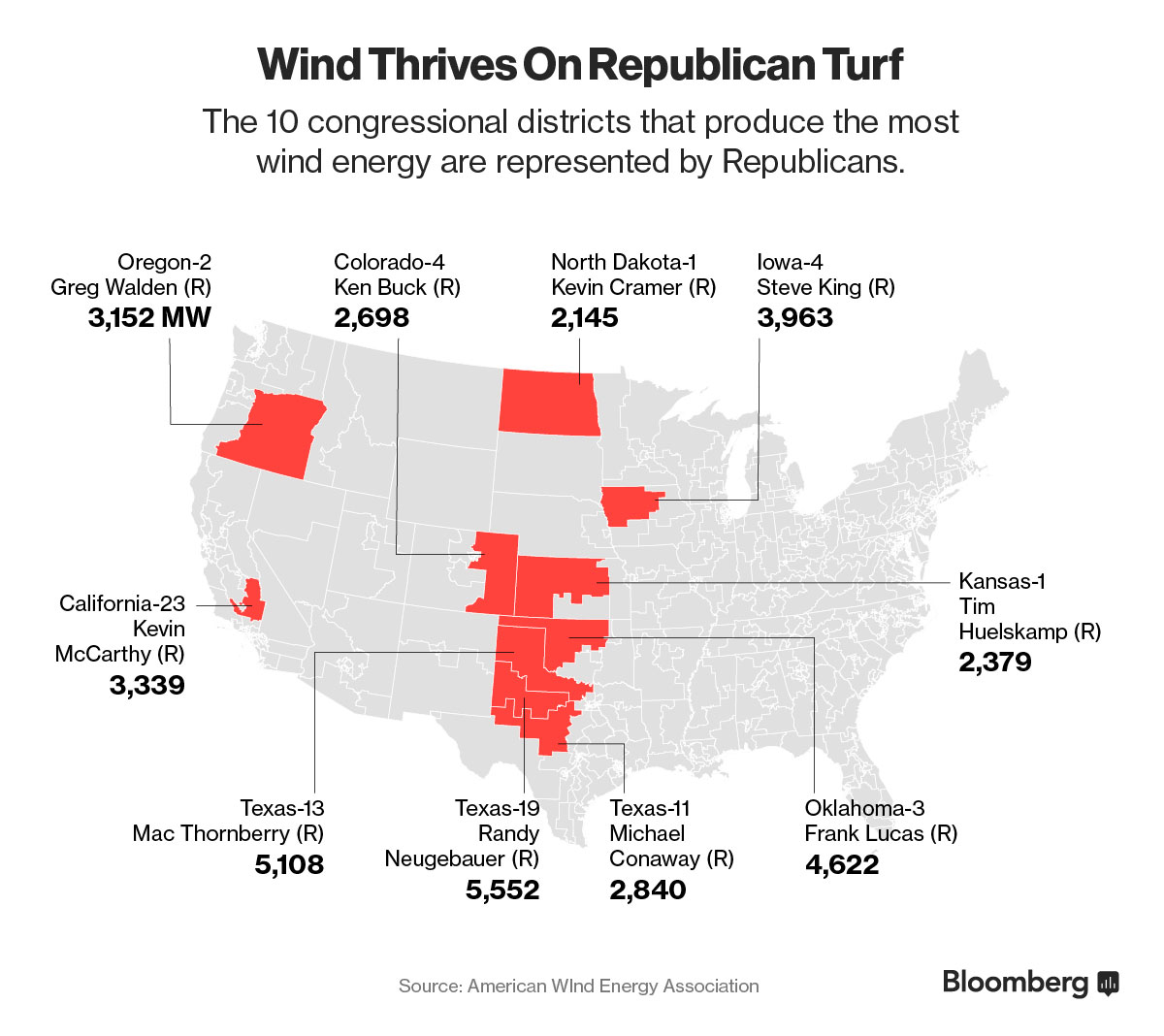

April 2016: A small but growing number of once-skeptical Republicans is embracing wind and solar energy as renewables add plentiful jobs in states like North Carolina, Georgia and Texas. Several factors are behind the conservative surge toward renewables. The first is economic; as prices drop and clean energy becomes less reliant on subsidies, supporting it is less problematic for Republicans. It is a powerful job creator, with wind and solar jobs now numbering four times as many as the coal sector. And wind and solar farms are often built on farmland, providing rental income for farmers and others in typically conservative parts of the country. In fact, all of the top 10 wind-energy producing congressional districts are represented by Republicans, according to The American Wind Energy Association.

India far surpasses target growth for renewable energy in 2015-16

April 2016: For the second year in a row, India’s renewable energy sector has surpassed target growth, by a substantial margin. In fiscal 2015-16, India beat its target of 4,460 MW of new renewables by more than 50%, adding 6,937 megawatts of new capacity. Solar was the big winner, with installations more than doubling the initial expectations. India also hit two major milestones: total installed wind capacity reached 25 gigawatts and for the first time, new solar additions were on par with new wind.

Port facilities could help Virginia create 14,000 offshore wind jobs

April 2016: Virginia could become a hub for the offshore wind industry and see as many as 14,000 jobs created over the next 15 years as the sector grows, according to a report issued by a group called the American Jobs Projec in collaboration with researchers at Virginia Tech. The report said the state is particularly well-positioned for the placement of offshore turbines because of port infrastructure such as at Hampton Roads, which could become an East Coast hub for shipping turbines and their components.

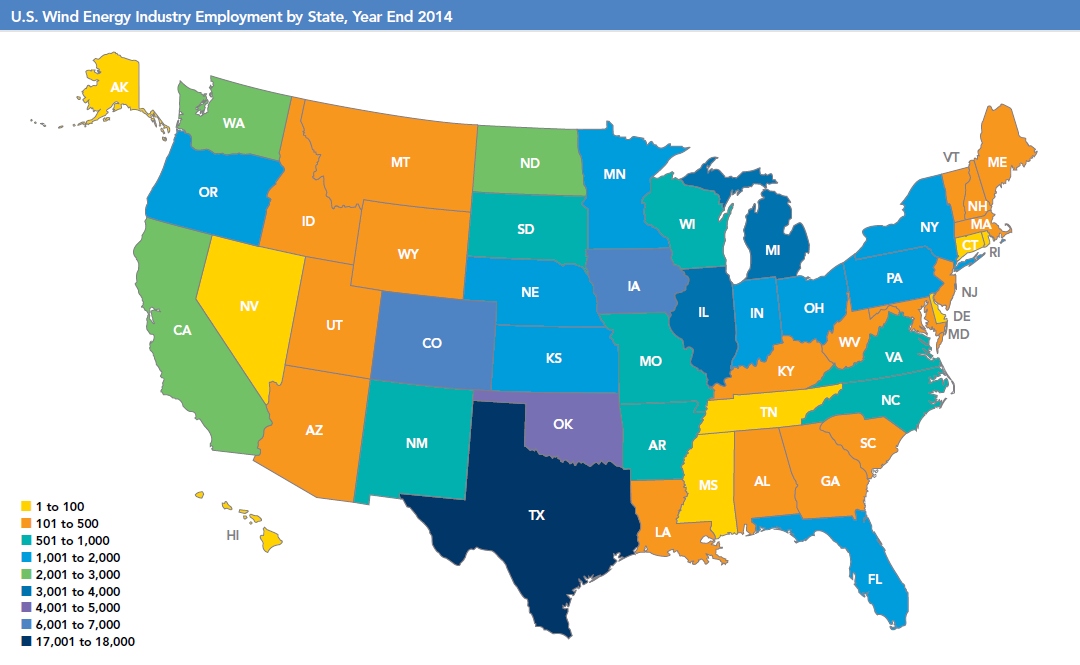

Wind industry jobs hit record in 2015

April 2016: The latest date from the wind industry show that wind power supported a record 88,000 jobs in the United States at the start of 2016, an increase of 20% for the year. According to the American Wind Energy Association’s Annual Market Report, the windpower workforce is on pace to grow to 380,000 jobs by 2030. “Wind power benefits more American families than ever before,” said Tom Kiernan, AWEA’s. “We’re helping young people in rural America find a job close to home. Others are getting a fresh chance to rebuild their careers by landing a job in the booming clean energy sector.”

IKEA selling solar panels in the UK

April 2016: How mainstream is solar becoming? IKEA has begun selling solar panels online and at three stores in the United Kingdom, and will make them available for purchase at all its stores by the end of the summer. The Swedish furniture giant decided to enter the market despite huge government cuts to solar subsidies for homeowners in Britain, saying it was confident there is still demand for the panels. “Our research showed a third of homeowners would really like to invest in solar, and the majority of those are driven by the opportunity to save money,” said IKEA’s head of sustainability at in the UK and Ireland.

As solar booms in India, costs are on the verge of beating coal

April 2016: Solar energy prices in India hit a new record low in January, and the country’s energy minister said solar would likely beat coal on cost. Speaking at the release of a new action plan for India’s renewable sector, Piyush Goyal said he thinks “a new coal plant would give you costlier power than a solar plant.” The winning bid in the January solar auction was for 4.34 rupees a kilowatt-hour, on par with coal prices that range between 3-5 rupees/kWh. As a result of solar’s increasing competitiveness, Goyal said India would quintuple its current target of 20 gigawatts of solar power generation by 2022 to 100 gigawatts.

Solar on the rise in Britain, surpassing coal for first time ever

April 2016: In a symbolic milestone, solar has provided British homes and businesses with more power than coal-fired power stations for the first time ever over an entire day. Data gathered by climate analysts Carbon Brief showed that solar provided the UK with 29 gigawatt-hours on April 9, compared with 21 GWh from coal. “This first for solar reflects the major shifts going on in the electricity system,” said Carbon Brief in an analysis. England now has 12 gigawatts of solar capacity, out of the UK’s total capacity of 80-90 GW. Meanwhile, while there was around 18GW of coal capacity going into last winter, this year there will be less than 10GW.

Obama statements wind costs beating out coal and gas hold water

April 2016: President Barack Obama has been on a streak of talking up the cost benefits of wind energy in 2016, and recent fact-checks of his statements have detailed the veracity of his statements. In his 2016 State of the Union address, the president said that “in fields from Iowa to Texas, wind power is now cheaper than dirtier, conventional power,” a fact backed up by data from the U.S. Energy Information Administration. And at a March rally in Dallas, the president said “Right now, here in Texas, wind power is already cheaper than dirty fossil fuels,” a statement that PolitiFact concluded was “true.”

With coal, oil and gas crashing, clean energy is crushing fossil fuels

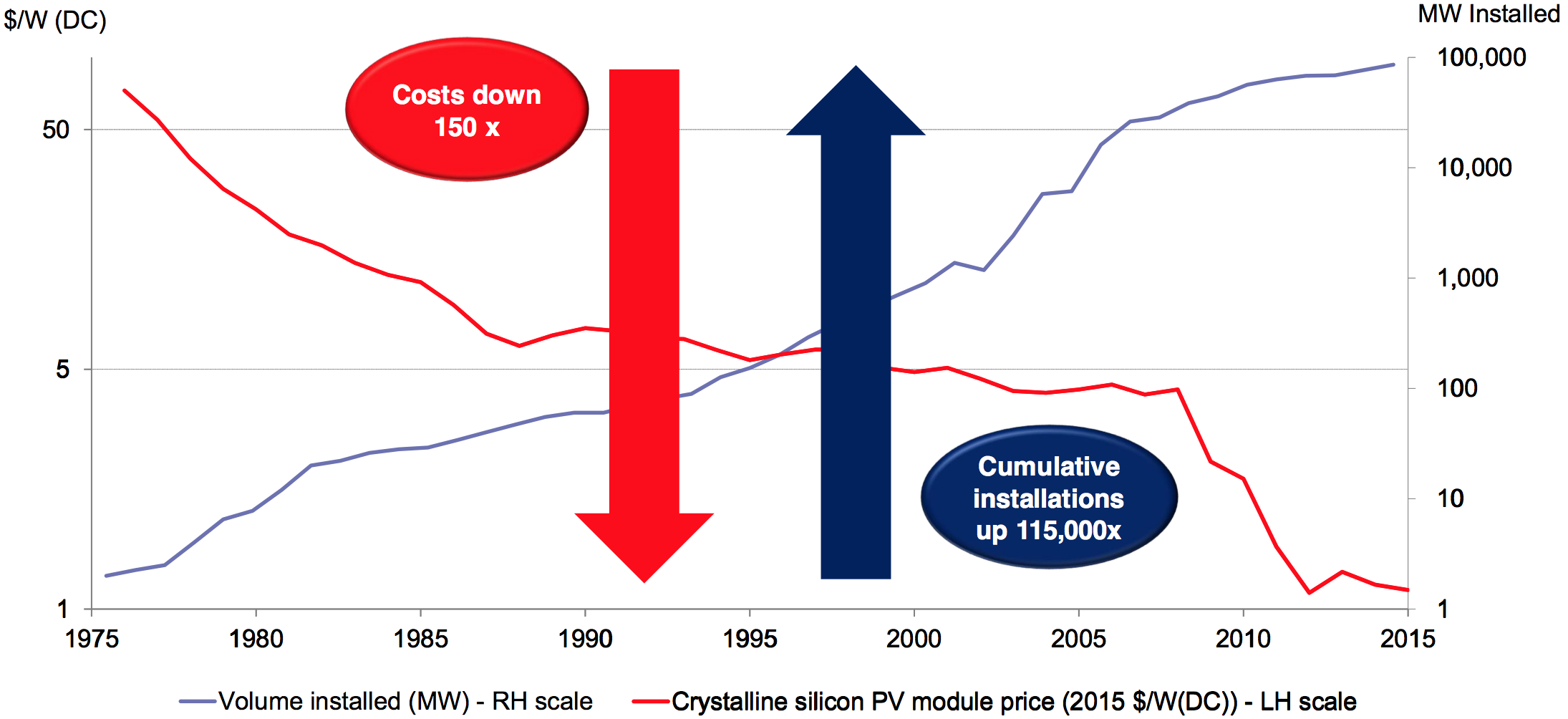

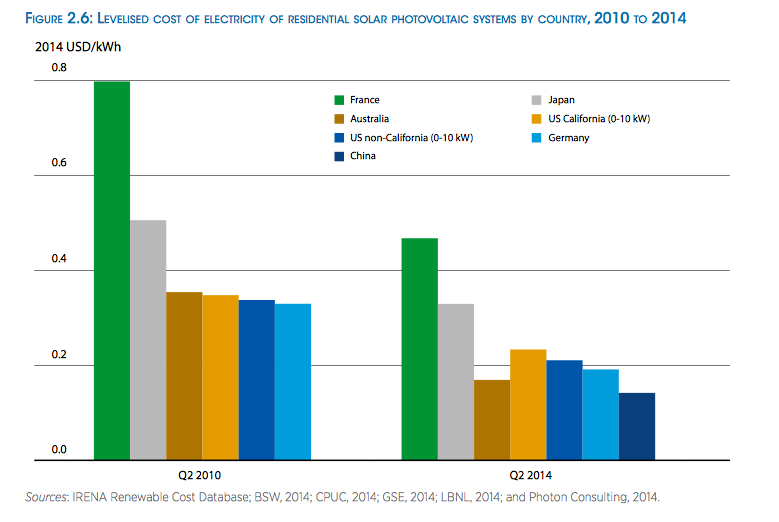

April 2016: With economies of scale finally ramped up, wind and solar are crushing fossil fuels on cost. According to Bloomberg New Energy Finance, the cost of solar has fallen to 1/150th its level in the 1970s, and the total amount of installed solar has soared 115,000-fold. Since 2000, the amount of global electricity produced by solar power has doubled seven times over, and wind power has doubled four times over.

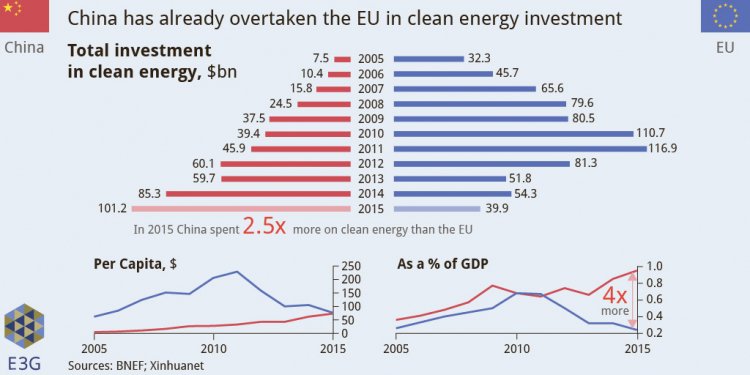

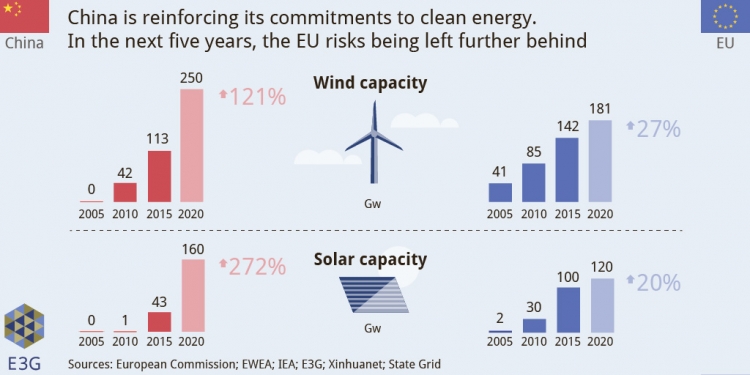

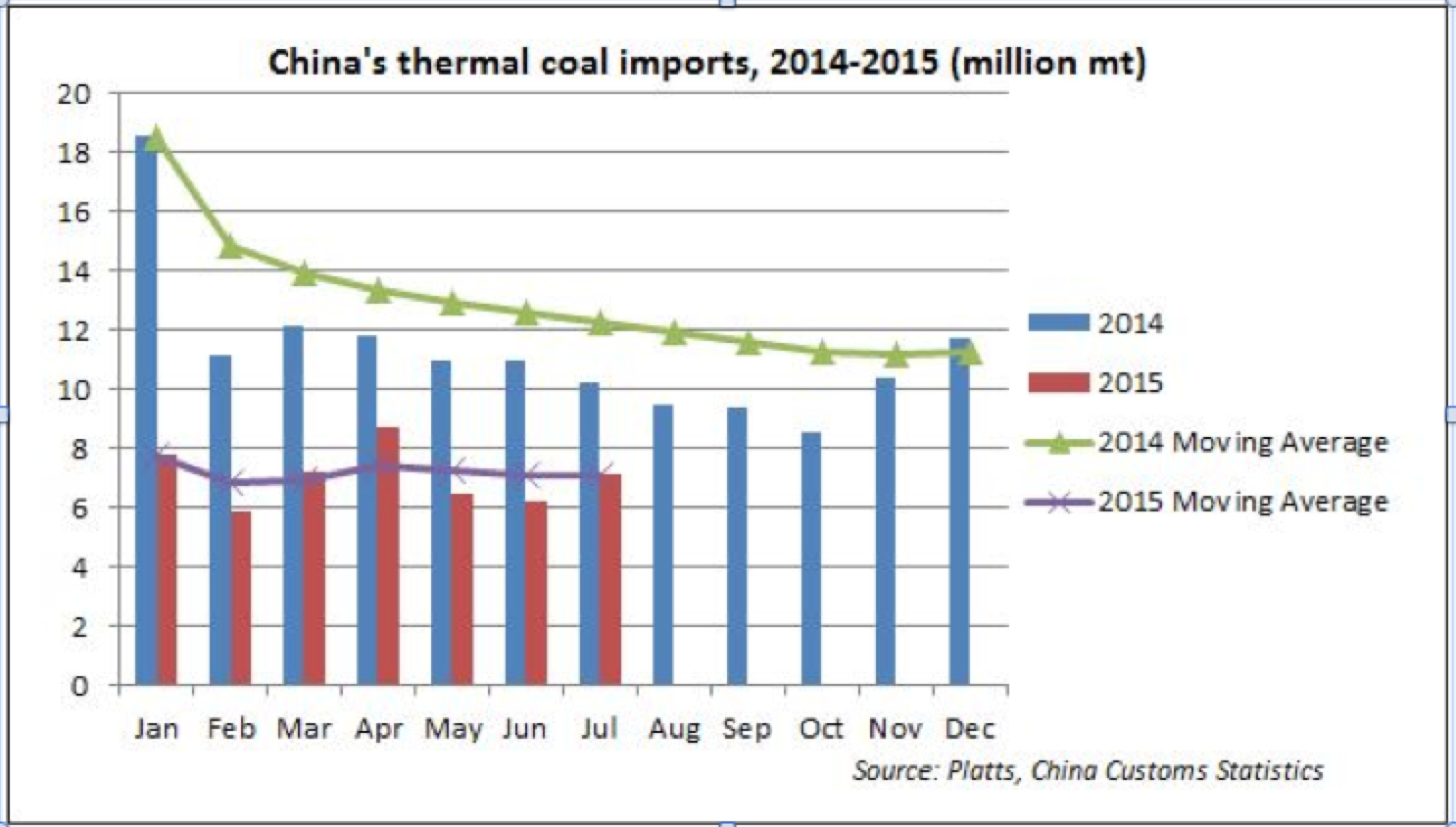

Surpassing Europe, China is on its way to global clean energy dominance

March 2016: By building infrastructure for cleaner electricity at a speedy clip, China is poised to overtake the European Union in a number of low-carbon economic measurements that will soon make it the dominant force in global clean energy development. According to a report by analyst group E3G, China’s new five-year plan lays out a plan to more than double its wind energy capacity, nearly triple its solar capacity and increase electric vehicle sales by a factor of 10. Chinese R&D spending on clean energy has risen 73% in the last five years, compared to just 17% in the EU.

NREL study: rooftop solar could provide 40% of U.S. electricity demand

March 2016: Rooftop panels could provide 40% of the electricity demand in the U.S. and as high as three-quarters in California, the most bullish state on solar, according to a new study from the National Renewable Energy Laboratory. A previous NREL study in 2008 determined that solar could supply about 21% of the country’s electricity demand, around 800 terawatt-hours a year. Improvements in the efficiency of panels and more accurate data analysis upped the estimate by 79% to 1,432 terawatt-hours annually, which would meet around 39% of U.S. electricity demand.

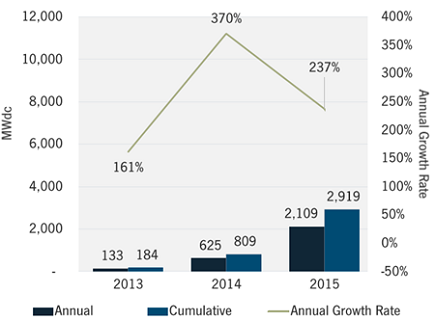

Utilities see explosive growth in community solar projects

March 2016: Growth in community solar programs over the six years is a further indication of the dramatic shifts taking place in energy markets. Community solar projects, or gardens, allow customers to buy shares of larger projects even if they can’t install solar panels on their own roofs. In 2010, there were only two shared solar projects in existence in the United States. Today, 77 utilities administer more than 110 projects across 26 states, accounting for a total capacity of about 106 megawatts, according to a new report by Deloitte.

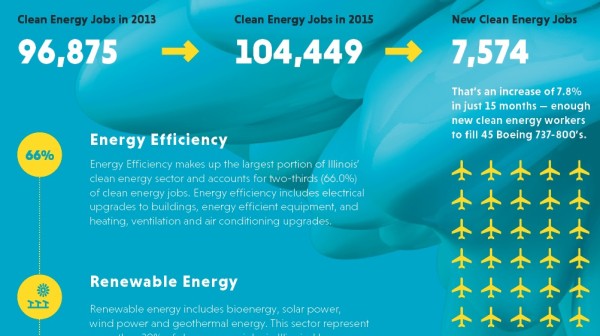

Over a half million Midwesterners employed in the clean energy sector

March 2016: Clean energy jobs are proving to be an economic powerhouse in the Midwest, with more than a half million workers employed in various sectors – renewable energy generation, clean transmission, energy efficiency, clean fuels and advanced transportation – according to a recent survey. Illinois led the pack with more than a fifth of the region’s 568,979 clean energy jobs. Looking ahead, clean energy employers project a growth rate of approximately 4.4% over the coming 12 months, which will add around 25,000 jobs and outpace the average employment growth rate over the next 10 years by a factor of nine.

DOE participation in Clean Line firms up clean energy transmission project

March 2016: After five years of review, the U.S. Department of Energy has decided to participate in the Plains & Eastern Clean Line Project, which will carry 4,000 megawatts of low-cost wind energy from Oklahoma and the Texas panhandle to the Southeast. The 700-mile Clean Line will deliver wind power to more than 1.5 million homes and businesses in Tennessee, Arkansas and other Southern states. DOE will help secure the transmission route, if and only if the developer can’t reach agreement with a state (Oklahoma and Tennessee have already endorsed the project).

100% of new generating capacity in January came from wind and solar

March 2016: In the first month of 2016, 100% of new electrical generating capacity in the U.S. came from renewable energy projects. According to the latest Energy Infrastructure Update report by the Federal Energy Regulatory Commission, there 468 megawatts of new wind and 145 MW of new solar added in January. No new capacity for nuclear, coal, gas or oil was reported. Renewables accounted for 64% of all new electrical generating capacity installed in 2015.

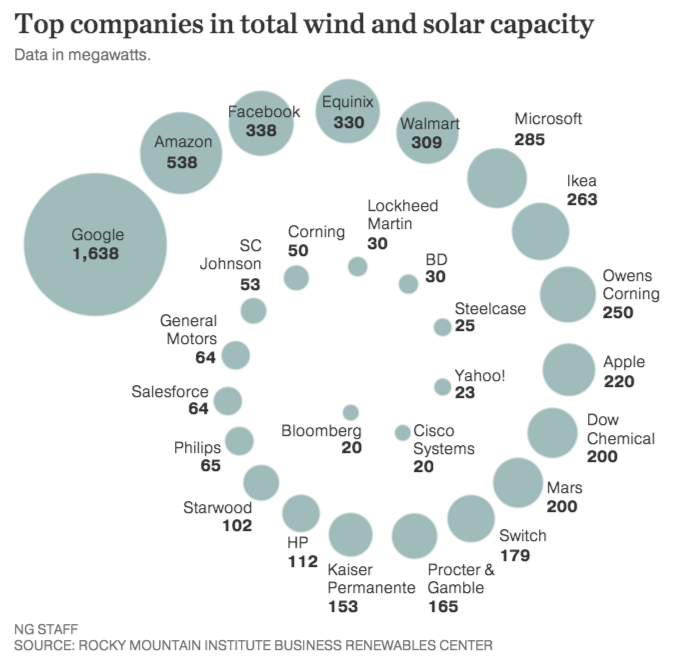

Old-school companies join high-tech ventures in ramping up renewables

March 2016: Digital-age companies like Google, Amazon, Microsoft and Apple still dominate the leaderboard for corporations turning to clean energy, but increasingly they are being joined by industrial and manufacturing stalwarts such as Lockheed Martin, Dow Chemical and Owens Corning. These companies recently signed long-term deals to buy clean energy to power their operations, taking advantage of wind and solar costs that continue to fall.

World’s largest battery storage system helps Korea cut energy costs

March 2016: Two massive energy storage battery systems installed in South Korea, which will be used to help regulate frequency variations on the grid, are expected to save the country’s largest utility millions of dollars. Korea Electric Power Corporation expects the two systems, one 24 megawatts and one 16 MW, to improve grid efficiency, allowing it switch to lower cost energy sources and cut down on wear and tear on plants and transmission equipment. The storage systems are expected to save the utility $13 million annually in fuel costs alone, three times the cost of the batteries.

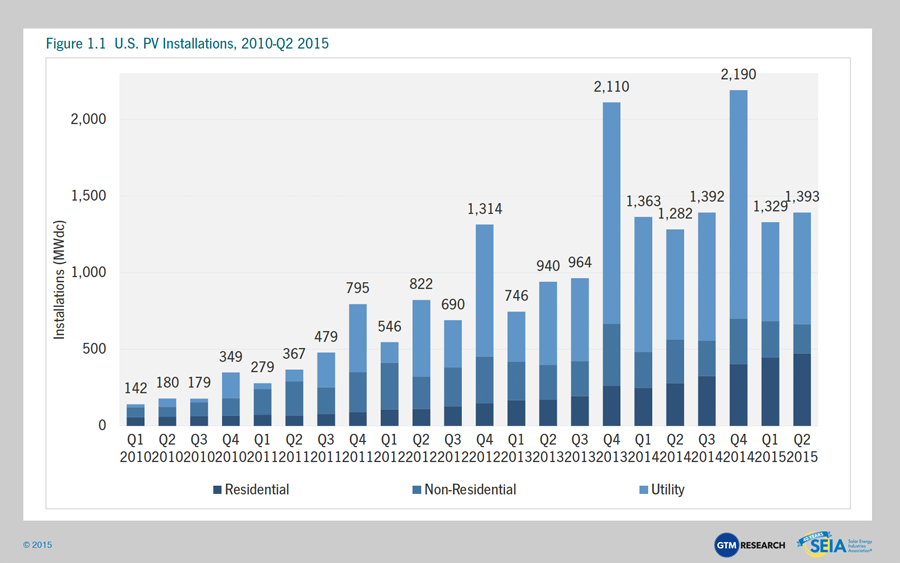

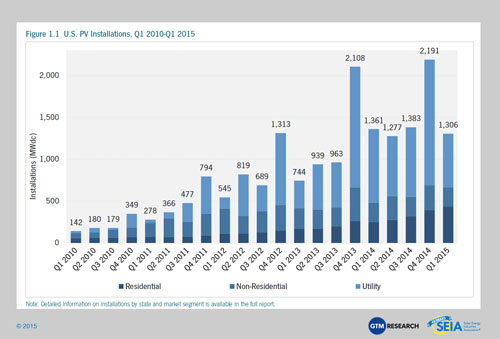

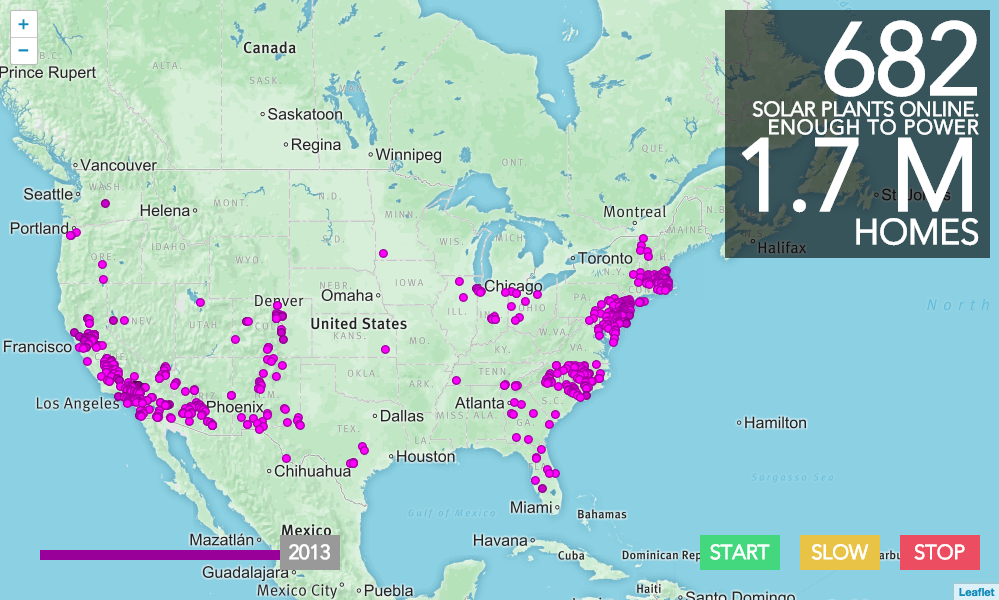

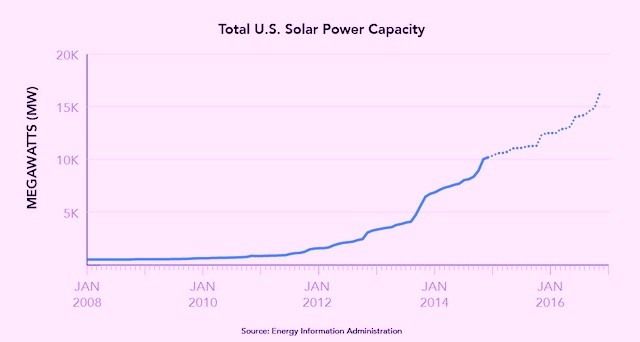

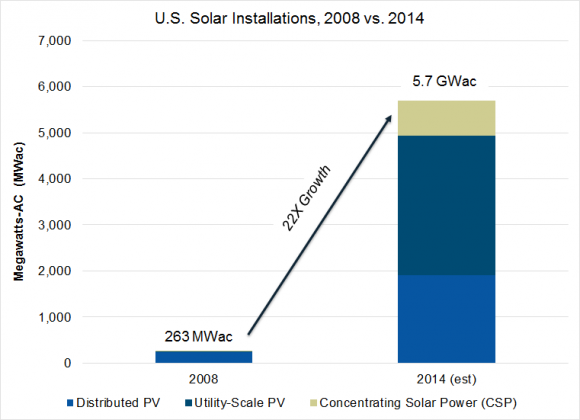

2015 a “monumental” year for solar

February 2016: Solar development surged again in the U.S. in 2015, with growth 17% higher than it was in 2014, which itself was a benchmark year. Nationwide, a record 7.3 gigawatts of capacity were installed in the U.S. last year. And for the first time, the capacity of solar installations surpassed those of natural gas. Residential rooftop PV was the fastest-growing segment, according to a report from GTM Research and the Solar Energy Industries Association. California, North Carolina and Nevada were the top three solar states in added capacity. Total U.S. solar installations now exceed 25 gigawatts, equal to about one quarter of the country’s nuclear fleet, and up from just 2 gigawatts only five years ago. Last year, said SEIO CEO Rhone Resch, “was a monumental year for us. What’s most amazing is that we’re just getting started.”

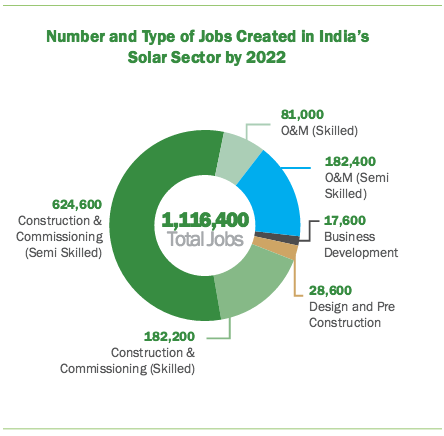

Analysis: India’s solar ambitions could create more than 1 million jobs

February 2016: India’s plans for a massive expansion of the nation’s solar sector could create more than 1 million new jobs, according to an analysis by the Natural Resources Defense Council and the Council on Energy, Environment and Water. The country has set a goal of adding 100 gigawatts of solar capacity by 2022. The analysis found that the build-out would require 210,800 skilled engineers, 624,000 construction works and 182,400 low-skilled workers for ongoing project operations and maintenance. The analysis does not take into account manufacturing jobs, which could also be significant.

Morocco striving for energy independence with solar projects

February 2016: As part of a move to become more energy independent, Morocco has officially flipped the switch on the first phase of what will be the world’s largest concentrated solar power plant. The Noor I power plant, located on the edge of the Sahara Desert, is capable of generating up to 160 megawatts of power. The next two phases will add another 300 MW of solar capacity. Combined, the three plants will provide enough energy to serve more than a million people. Using molten salt technology, they will also be capable of generating electricity after nightfall. Morocco currently relies on imported sources for 97% of its energy consumption.

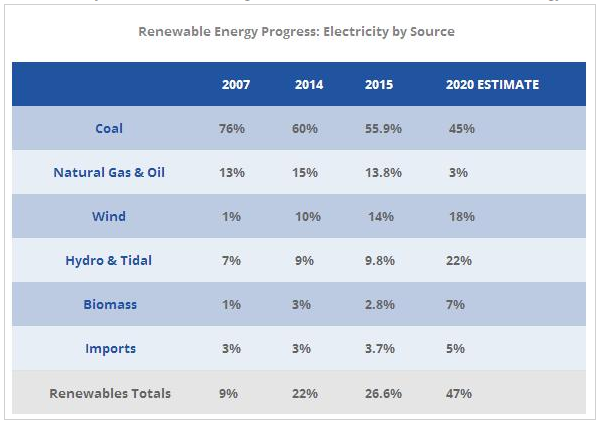

Wind helps Nova Scotia meet clean energy goals, stabilize prices

January 2016: The main electricity provider for the the Canadian province of Nova Scotia set a new renewable energy record in 2015, with wind, hydropower and biomass contributing 26.6% of its electricity over the course of the year. The total exceeded the benchmark of 25% required by law. Nova Scotia Power said it is on target to meet the 40% renewable requirement by 2020. As recently as 2007, only 9% of Nova Scotia’s electricity came from renewables. Just as notable, utility officials said the transition is helping stabilize power rates. For most customers, rates did not increase in 2015 and have gone down in 2016. Wind makes up the lion’s share of the new generation being addd in Nova Scotia.

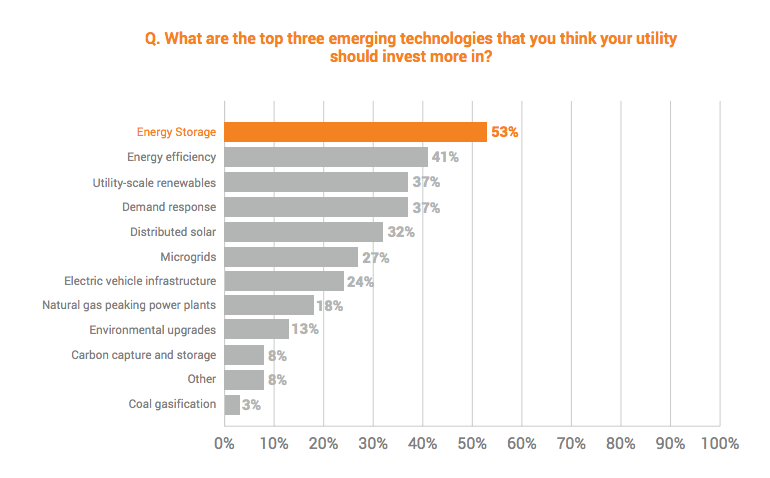

New frontier of battery storage to grow 15-fold in next 10 years

January 2016: World-wide revenue for utility-scale battery energy storage is forecasted to grow 1,500% over the next decade, expanding from $231.6 to $3.6 billion by 2025, according to an analysis by Navigant Research. Buoyed by new business models and financing investors are pouring money into new generation batteries that helps stabilize the grid and improves the economics of individual generating facilities. The increased investment is expected to lead to even bigger growth in storage capacity, which is projected to expand 30-fold to 42.7 gigawatt-hours by 2025. ability of the grid.

India dramatically expands solar capacity, drives record low prices

January 2016: With a rapid expansion of its solar capacity driving the market, India is seeing record low bids come in for new projects>. In late 2015 and the beginning of 2016, there have been a wave of bids for solar costing in the range of $.07 per kilowatt-hour. Just a year ago, solar contributed almost none of the country’s power. By 2021 the Institute for Energy Economics and Financial Analysis estimates that solar will contribute 10% of India’s electricity.

Tiny Cook Islands big on clean energy

January 2016: After an effort to transfrom its energy that began just six years ago, the tiny nation of the Cook Islands in the South Pacific is now on track to provide 100% of its electricty with renewables by 2020. The country, comprising 15 islands southwest of Tahiti set its course for a transition to renewable energy in 2010 to wean itself off of expensive imported diesel-generated power.

Municipal buildings in Santa Monica to be powered 100% by clean energy

January 2016: The city of Santa Monica, Calif. has signed a contract that will supply all of its municipal operations with 100% renewable energy, most of it solar and wind power generated in California. The contract will provide clean energy for more than 500 city-owned accounts.

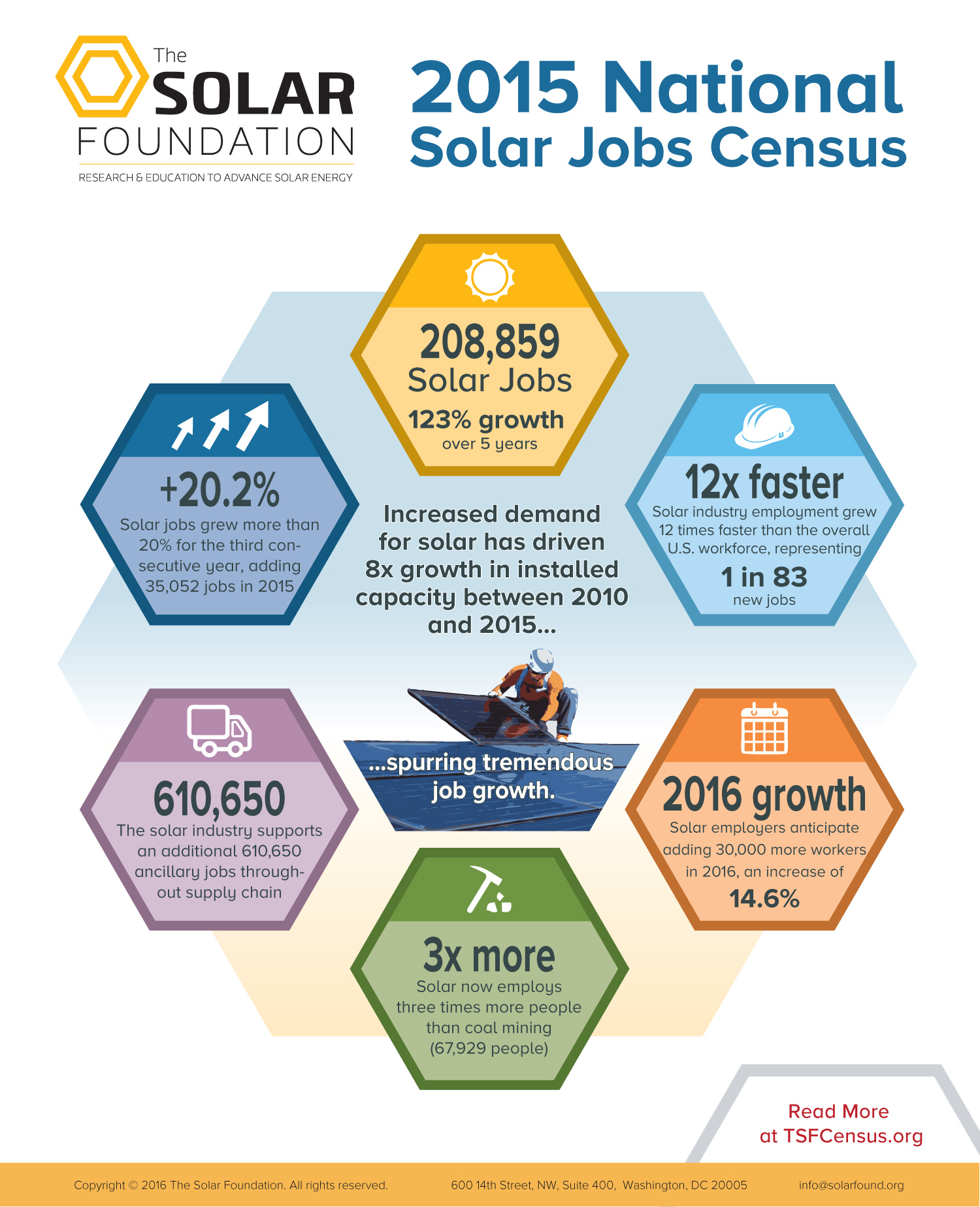

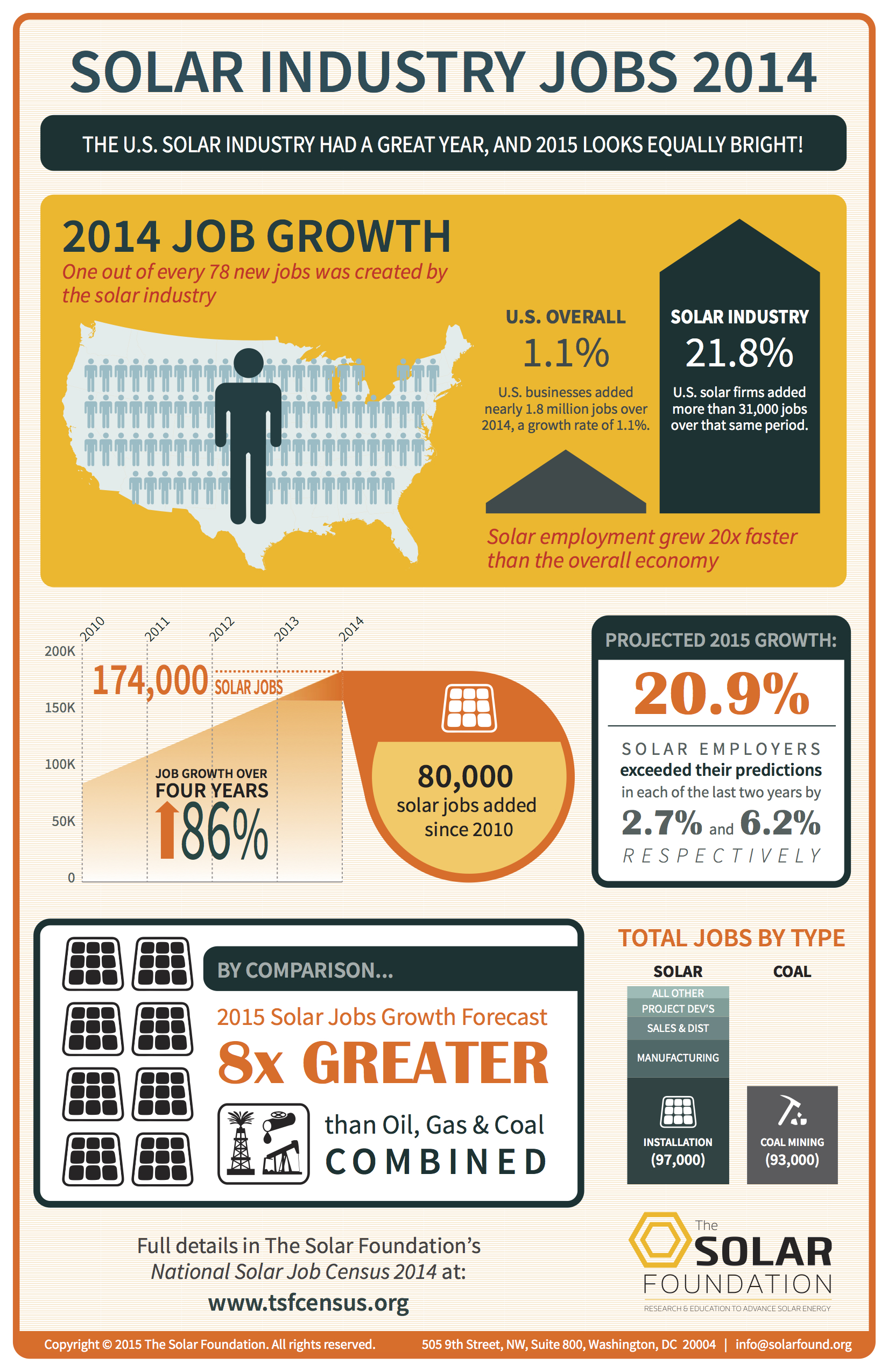

Solar jobs growing at meteoric pace

January 2016: Employment growth in the U.S. solar industry continued its rapid expansion in 2015, adding 35,052 new workers over the year, according to the latest annual jobs census by The Solar Foundation. With an employment increase of 20%, the solar sector grew nearly 12 times faster than the national employment growth rate of 1.7% last year. In fact, one out of every 83 new jobs created in the U.S. last year was in the solar industry. Since 2010, employment in solar has grown an extraordinary 123%, and projections are for that pace to continue. Companies surveyed for the census expect to see total employment in the solar industry increase by 14.7% to 239,625 solar workers in 2016. “Solar is surging. Renewable energy deployment is on track to transform our world,” said former U.S. Labor Secretary Hilda Solis.

France installing innovative, durable solar panels on 1,000 km of roadways

January 2016: In a unique new appiclation for solar, France will install flexibile, traffic-durable solar panels on 1,000 kilometers of roadway over the next five years, providing enough electricity to power public lighting for a city of 5,000 a thousand times over. The project is a private-public collaboration between French a transport infrastructure company Colas and France’s National Institute for Solar Energy. The panels, just 7 millimeters thick and made of layers of material “that ensure resistance and tire grip,” are glued on the top of existing pavement and strong enough to stand up to regular traffic, even heavy trucks.

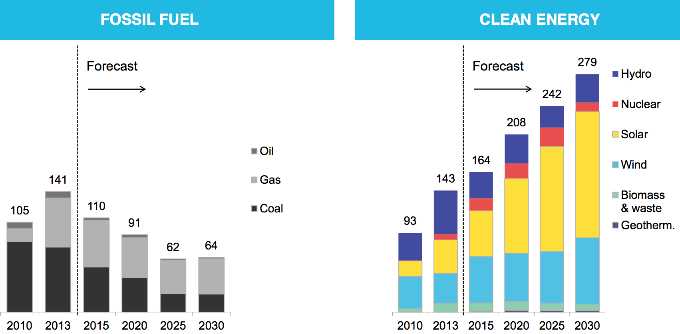

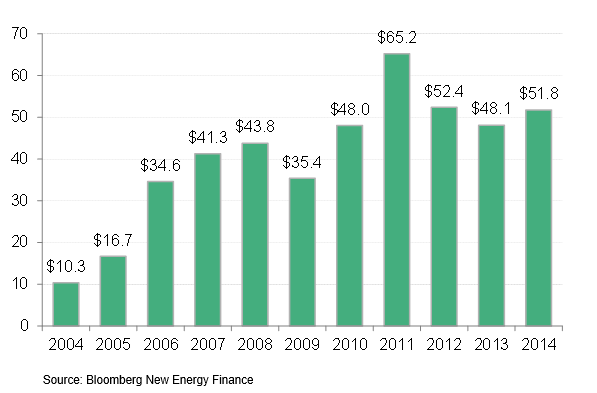

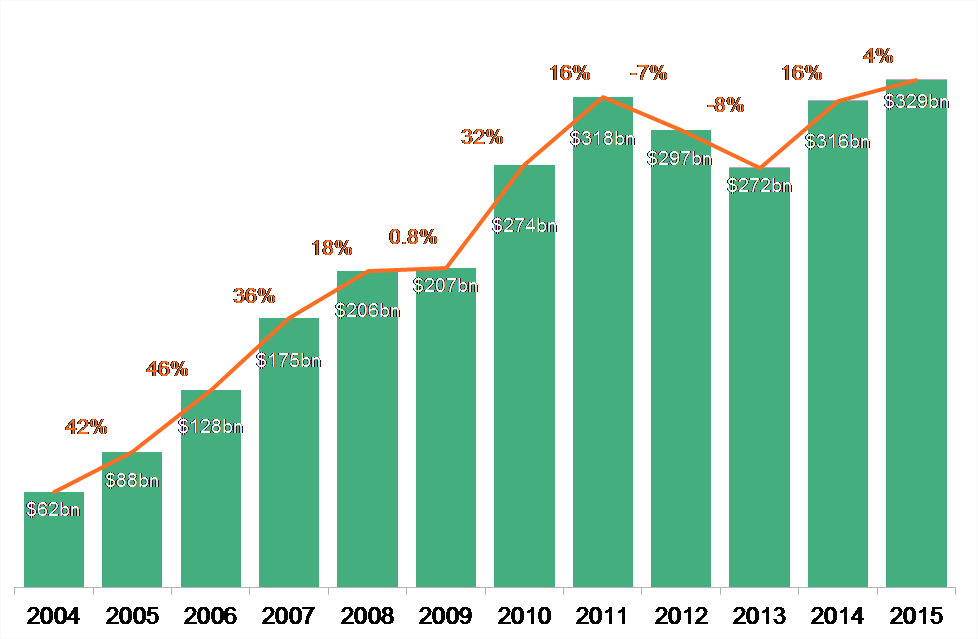

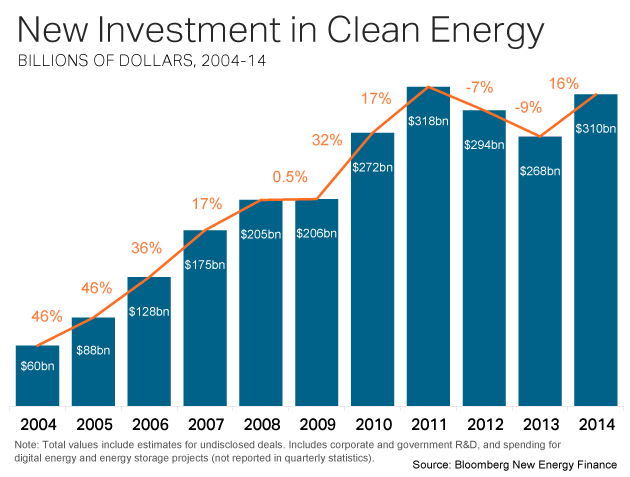

Despite Cheap Fossil Fuel, Clean Energy Set Records In 2015

January 2016: Worldwide clean energy investment and installations both surged to their highest levels ever in 2015, according to a report from Bloomberg New Energy Finance. Total investment in solar, wind and other renewables rose 4% from 2014, reaching $329 billion, while both wind and solar PV saw around 30% more capacity installed worldwide in 2015 than the previous year. Moreover, BNEF noted that the records were set despite plunging fossil fuel prices. “These figures are a stunning riposte to all those who expected clean energy investment to stall on falling oil and gas prices,” says Michael Liebreich, chairman of the advisory board at BNEF. “They highlight the improving cost-competitiveness of solar and wind power.”

Source: Bloomberg New Energy Finance

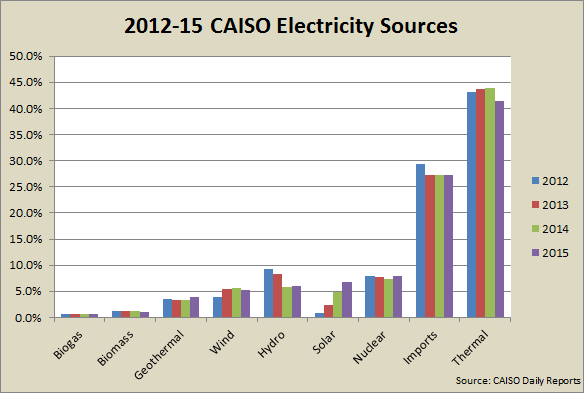

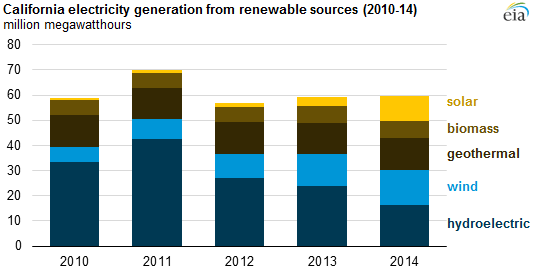

Solar is now California’s leading source of clean energy

January 2016: Rapid expansion has made solar the top renewable energy source for the grid serving about 80% of California. According to California Independent System Operator data, utility-scale solar now comprises 6.7% energy on the system, wind 5.3% and hydropower 5.9%. If rooftop solar were also counted, it would increase solar’s share to nearly 10% of the state’s electricity. Three years ago, solar contributed just was 0.9% of CAISO’s generation mix. Renewables now account for 24.3% of the state’s energy, coal less than 1%.

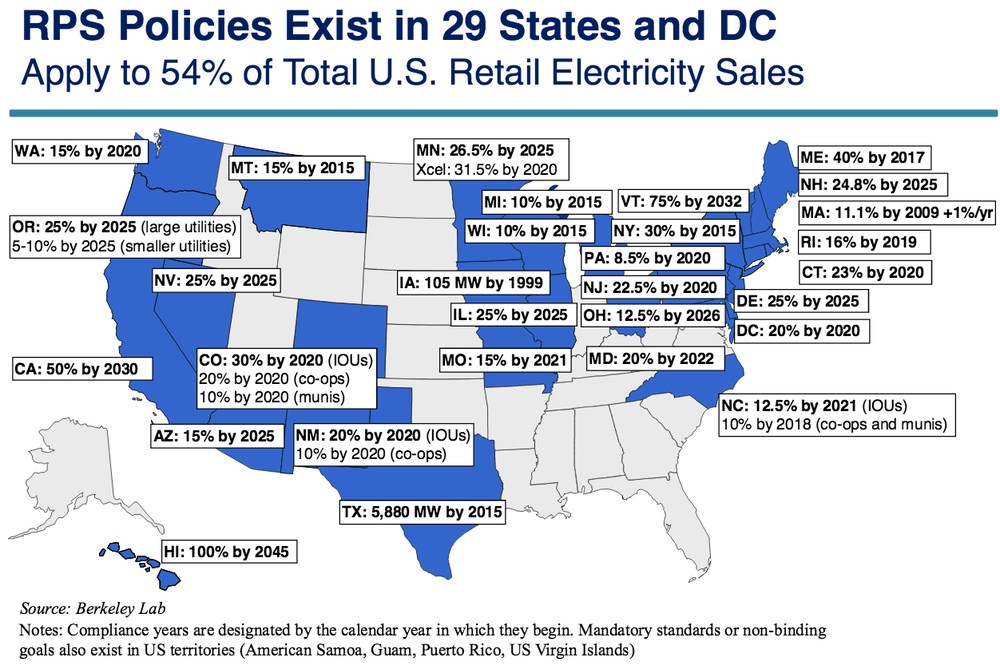

Research: State RPS’s provide $7.4 billion in pollution-cutting benefits

January 2016: A new study by federal energy researchers estimates that nationwide the net benefits of pollution cuts from state renewable portfolio standards collectively totaled $7.4 billion 2013, dwarfing the costs of the rules. The analysis, conducted jointly by Lawrence Berkeley National Lab and the National Renewable Energy Lab, calculated the net benefits of reducing greenhouse gas emissions at $2.2 billion and the benefits of cutting other air pollution – such as fewer lost work days and hospital visits – at $5.2 billion.

Better ecomonics prompt Indian coal plant builder to switch to solar

January 2016: Saying the economics of photovoltaics are more attractive, a prominent developer of coal-burning power plants in India has changed course on a 800-acre site planned for a coal plant in the state of Punjab and decided to build a solar project instead. According to the report in Bloomberg, the decision is the latest example of India’s increasing interest in solar. Prime Minister Narendra Modi has set a target of installing 100 gigawatts of new solar capacity by 2020. The Indian government has created numerous incentives and regulations to attract overseas developers, a move that has reduced the cost of solar electricity to record lows.

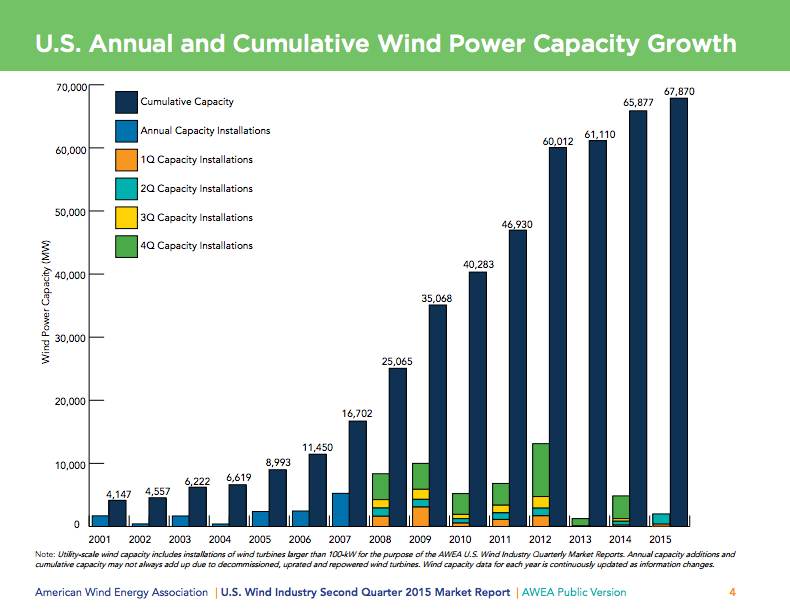

U.S. wind industry cracks 70 GW of capacity, and more is on the way

December 2015: The U.S. wind industry reached a new milestone in November, topping 70 gigawatts of installed generating capacity nationwide, enough to power about 19 million homes. According to the American Wind Energy Association, there are more than 50,000 wind turbines operating across 40 states and Puerto Rico. Wind suprassed the 50 GW and 60 GW milestones in 2012. In just eight years, wind power has gone from producing less than 1% of America’s electricity to 5% now. And with Congress enacting a 5-year extension of federal tax credits for wind and a new climate agreement in place from Paris, growth in wind is on-track to meet DOE projections for generating a fifth of the country’s electricity by 2030.

African nations use Paris to map out plan for doubling clean energy

December 2015: As part of the climate accord brokered in Paris, African nations have announced an ambitious goal to tap into the continent’s “massive potentials” for renewable energy by building at least 300 gigawatts of new clean energy capacity in the next 15 years. The plan, backed by commitments from a $100 billion annual fund pledged by wealthy countries to fight climate change, would double Africa’s total generating capacity, which currently is about half as much as Japan, a country with one-tenth Africa’s population.

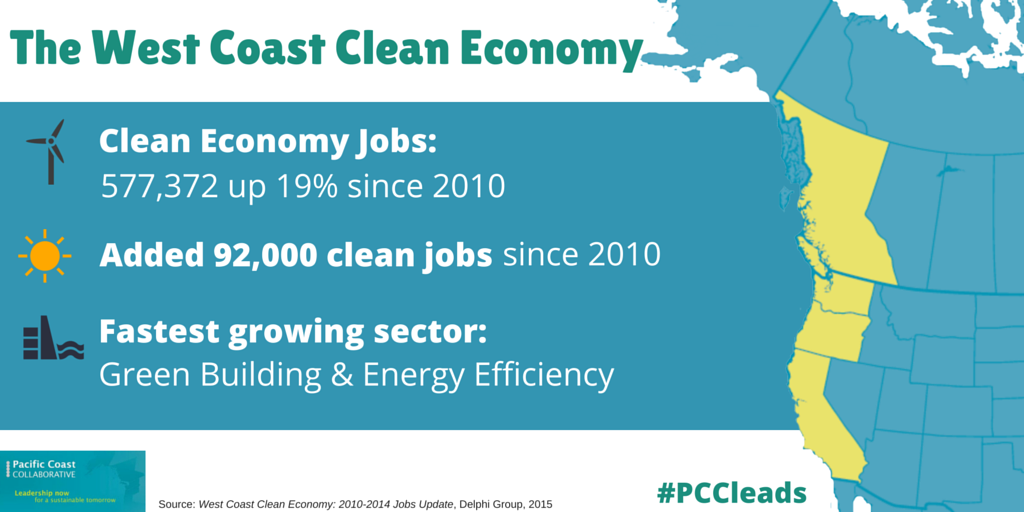

Study: Pac Northwest’s cleantech growth outpaces overall economy

December 2015: The Pacific Northwest’s clean economy is growing at a rate twice as fast as the overall economy, according to a new study. The West Coast Clean Economy: 2010-2014 Jobs Update, compiled by the Delphi Group, looked at economic drivers in Oregon, Washington, California and British Columbia, which have a combined GDP of $2.8 trillion and together represent the world’s fifth largest economy. As of 2014, the region housed 577,372 clean economy jobs, an increase of 19% since 2010.

Las Vegas city buildings to be powered 100% by renewable energy

December 2015: The city of Las Vegas will be powered exclusively by renewable energy, city officials have announced. As part of an expanded partnership with utility NV Energy that will provide a mix of energy-efficiency programs and a large-scale solar project, all fire stations, streetlights, city parks and other municipal facilities in Las Vegas will be powered completely by clean energy within two years. The move would make Las Vegas the largest city in the U.S. with municipal operations completely powered by renewable energy. City officials said the deal was possible due to dramatically falling costs; solar, for example, is roughly half the price it was just five years ago. “It’s cheaper than what we could build a new natural gas plant for,” NV Energy’s president told the Las Vegas Sun.

Pennsylvania boosts clean energy commitment as part of climate plan

December 2015: The newest update to Pennsylvania’s climate change action plan includes a significant expansion of renewable energy and added energy efficiency programs, as well as fixing methane leaks from natural gas pipelines and coal mines. The actions are some of the dozens of steps laid out by the state’s Department of Environmental Protection to help limit the damage caused by rising global temperatures, which the report calls “one of the most serious issues facing the world.” Pennsylvania is the third largest emitter of energy-related carbon dioxide in the country, but the plan has the potential to reduce greenhouse gas emissions by 338 million metric tons CO2 equivalents through 2030.

Everything is big in Texas, especially projected growth in renewables

December 2015: The vast majority of new electricity generation in Texas will come from renewable enegy, especially wind power, in 2016. The Electric Reliability Council of Texas, which manages nearly 90% of the state’s grid load, also projects that solar power growth will exceed natural gas capacity next year. In 2016, ERCOT anticipates adding more than 4,200 megawatts of new power capacity, including nearly 2,800 MW of wind power, more than 1,000 MW of solar and the remaing 10% from a new natural gas plant. By 2018, ERCOT expects the amount of solar on the grid in Texas to grow tenfold to about 2,000 MW.

Bill Gates sets sights on renewables

November 2015: Microsoft co-founder Bill Gates has made renewable energy his next big project, pulling together a multinational band of investors to pump billions in clean energy. The goal of the group, called the Breakthrough Energy Coalition, is to continue lowering the cost of clean energy to make it competitive with fossil fuels in order to get poor countries to make the switch without sacrificing economic growth. The coalition comprises more than two dozen public and private entities, including national governments, billionaire philanthropists, investment fund managers and tech CEOs.

Alberta officials set bold clean energy goals in home of tarsands

November 2015: Under new leadership elected earlier this year, Alberta’s provincial government has set a goal of getting a third of its electricity from renewable energy and completely phasing out coal by 2030. ”This is the day we start to mobilize capital and resources to create green jobs, green energy, green infrastructure, and a strong, environmentally-responsible, sustainable and visionary Alberta energy industry with a great future,” Alberta Premier Rachel Notley said in a speech during the plan’s roll-out.

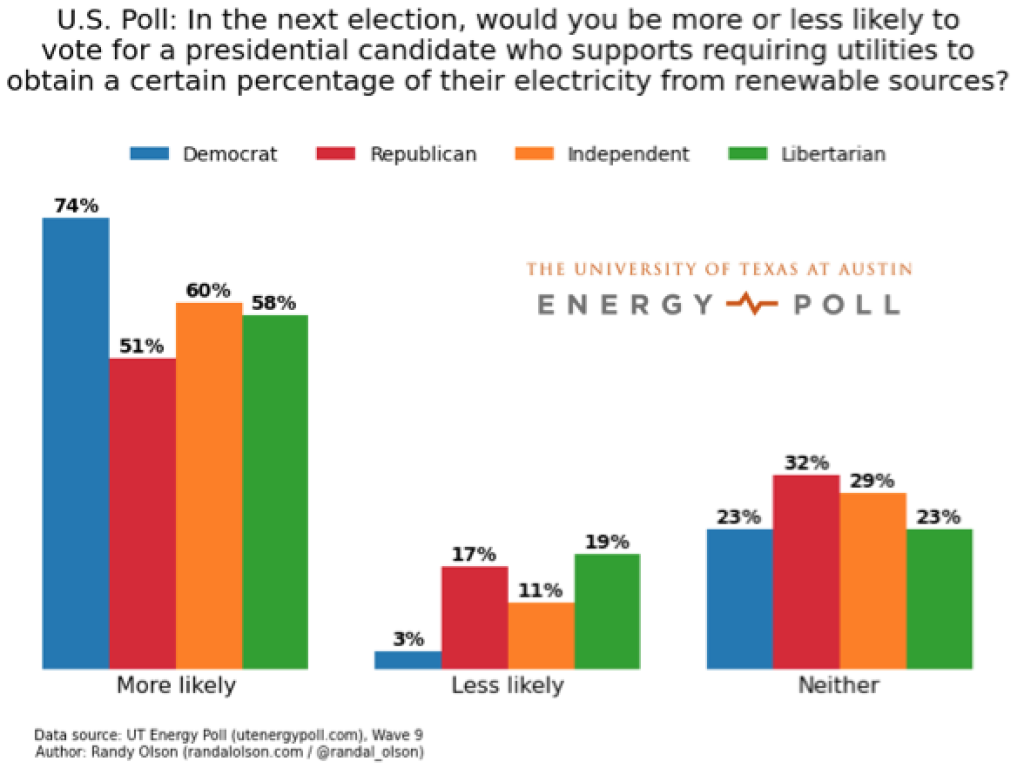

Voters in 6 swing states favor clean energy, support Clean Power Plan

November 2015: Voters in six key swing states overwhelmingly want power generated by wind and solar over coal and natural gas, according to polling commissioned by the Sierra Club. The poll surveyed between 550 and 770 registered voters each in Ohio, Illinois, Missouri, Iowa, Virginia and Maine. It also found that clear majorities in all six states support the Clean Power Plan, and that voters in four states would be more likely to vote for a U.S. Senate candidate who supports the plan

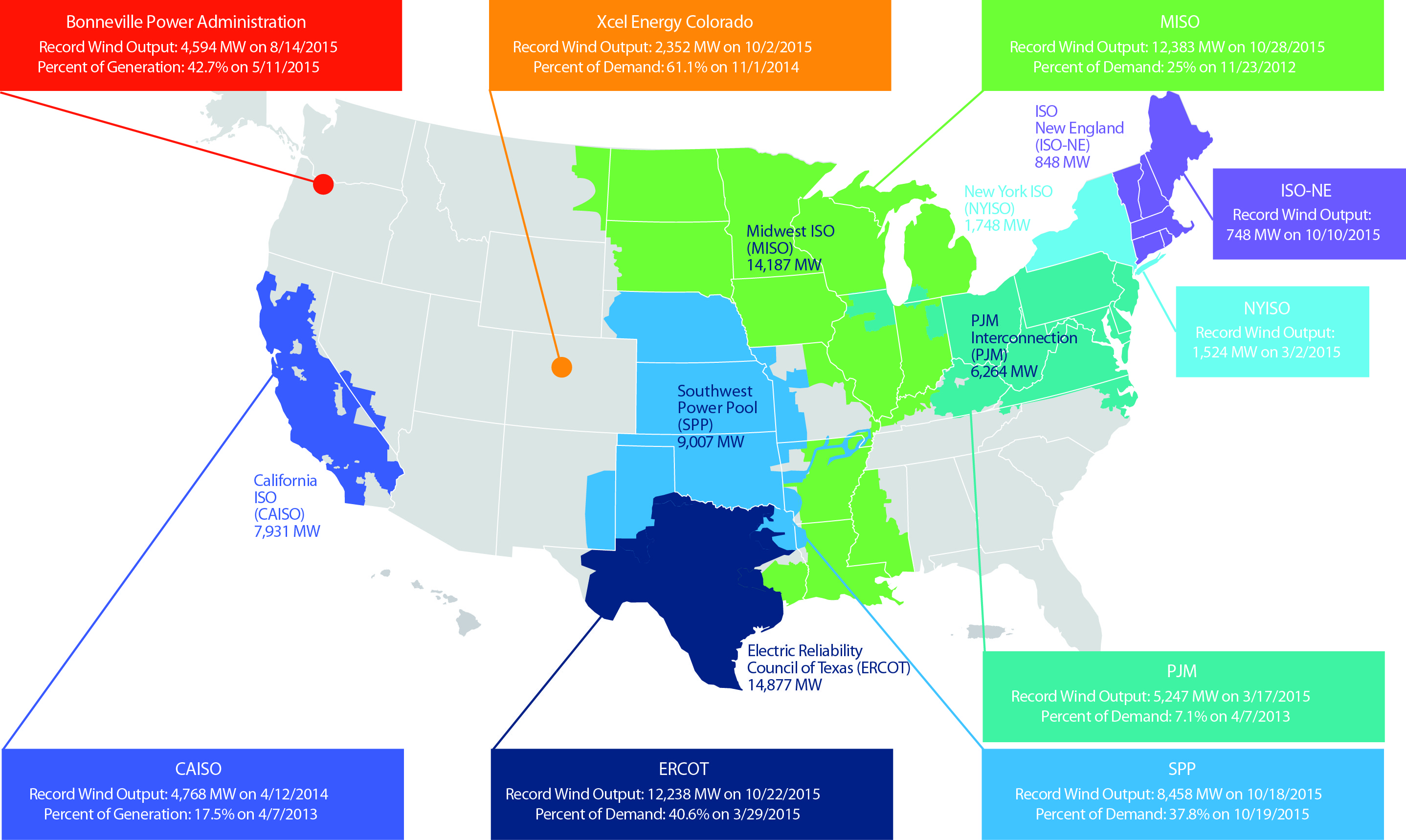

Winds blow big in October, setting numerous output records

November 2015: October saw wind energy output records fall across the country as a result of a “wind rush” of projects and long-needed grid upgrades coming online. Both the Texas and Midwest grid operators passed the milestone of 12,000 megawatts of wind output in the third week of the month, trading spots for all time peaks for a regional grid operator. On Oct. 2, Xcel set a new record of 2,352 MW of wind output in Colorado. The grid operator for Oklahoma, Kansas, Nebraska, and parts of neighboring states, hit 8,458 MW of wind on Oct. 18, and the American Wind Energy Association is working to validate record outputs for grid operators in the Mid-Atlantic and Great Lakes regions, as well.

Source: AWEA

China’s solar capacity projected to jump fourfold by 2020

October 2015: China’s solar capacity, already the biggest in the world, will balloon more than fourfold by 2020, according to a senior official. The Chinese government’s goal is to increase solar PV capacity by 20 gigawatts annually from 2016 to 2020. Total solar capacity will reach 150 GW over that timeframe, up from 35.8 GW this summer.

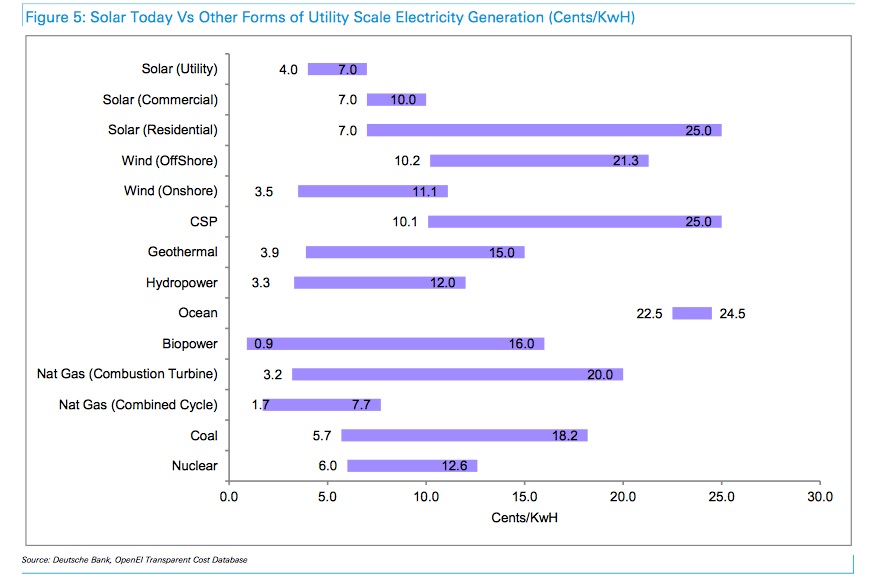

New Mexico utilities expand solar at bargain basement prices

October 2015: Utilities in New Mexico have announced three large-scale deals that will add 165 megawatts of solar to the state. Southwest Public Service Co., a subsidiary of Xcel Energy, has signed a long-term agreement to buy power from two 70 MW solar facilities being built near Roswell. Southwest will pay about 3.5 cents per kilowatt-hour starting in 2017, one of the cheapest power agreements in the nation for utility-scale solar and less expensive than some of Excel’s older natural gas plants. “The way the economics are changing, we’re often looking to add renewables now because of the economic value and the diversified mix of energy it provides for our system,” an Xcel splkesman said. Colorado-based Tri-State Generation and Transmission, also announced a deal to build a 25-MW solar facility in Luna County.

Calif. ups the ante on renewable energy, efficiency with new law

October 2015: In signing a sweeping new law for a for a “decarbonized future,” Gov. Jerry Brown has put California’s clean energy policies even further ahead of the pack. The measure expands the state’s renewable energy standard, requiring it to generate half of its electricity from solar, wind and other renewables by 2030, and it doubles energy efficiency requirements for homes, offices and factories. Brown said the legislation was necessary both to combat climate change and to continue cleaning up air in cities where pollution is still problematic. The bill also lays the groundwork for a regional electricity grid, which could make renewable energy more available throughout the West.

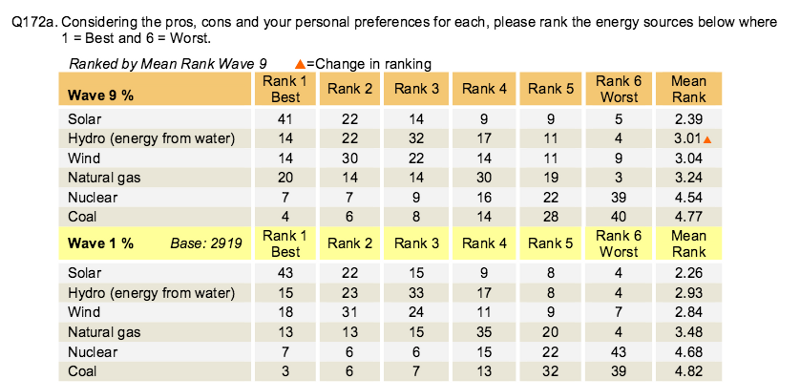

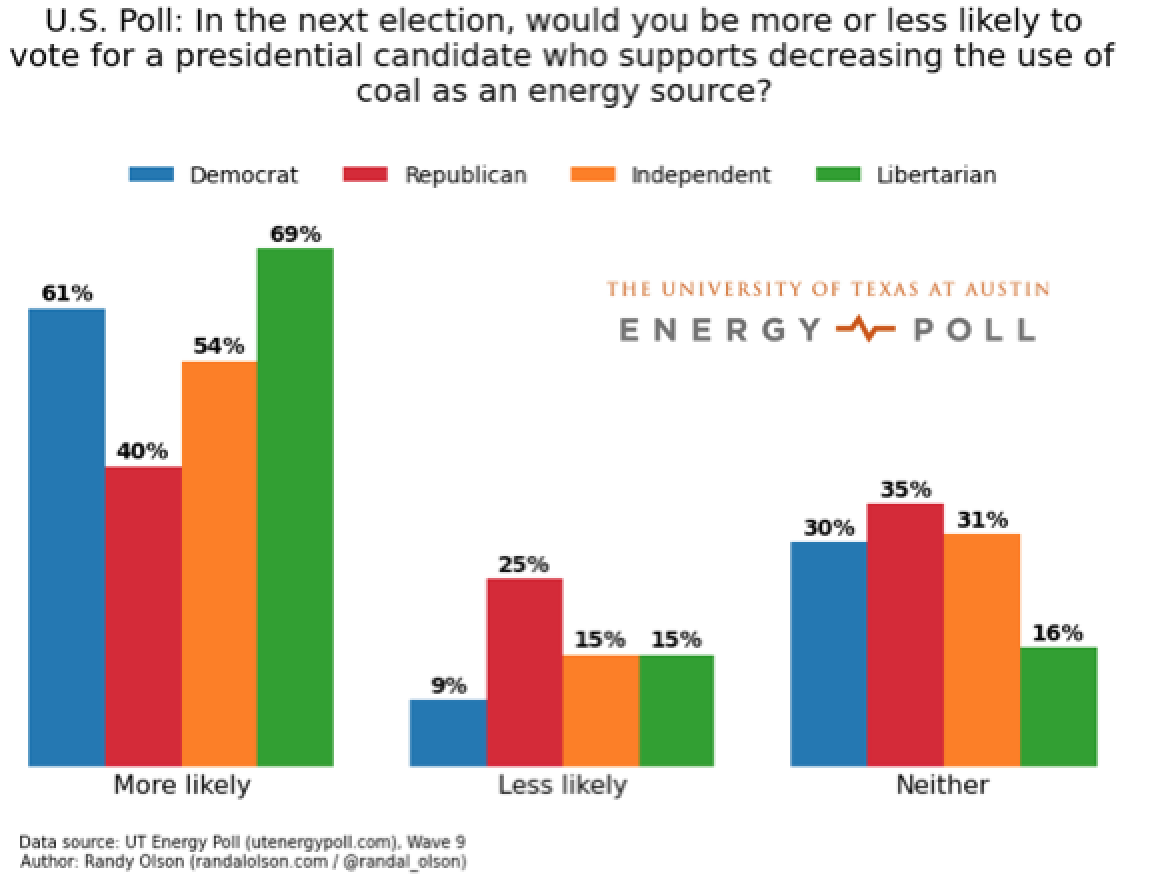

Poll: Americans support clean energy, don’t like coal much

October 2015: A new nationwide poll shows that large majorities of Americans support renewable energy like solar, while coal is considered “the worst” energy source than any other form of energy. In the poll, conducted by the University of Texas at Austin, 41% of Americans said ranked solar energy as the best energy source for the country, while coal was ranked the worst by 40% of Americans, slightly ahead of the next least favorite, nuclear power. The poll also found that opposition to coal translates to support for candidates working to move us away from it as an energy source.

Global clean energy, fossil fuel costs headed in opposite directions

October 2015: An analysis of the levelized cost of electricity worldwide showa average onshore wind and solar costs continuing to decline while those for coal and natural gas were on the rise for the second half of 2015. The Bloomberg New Energy Finance analysis, based on thousands of cost data points from projects around the world, found that the global average levelized cost of electricity for onshore wind fell from $85 per megawatt-hour in the first half of the year to $83 in the second half, while that for solar PV solar fell from $129 to $122. In the same period, the cost for coal-fired generation both increased. Onshore wind, the data showed, are now fully competitive against gas and coal in Europe.

Official says China will quadruple solar capacity in next five years

October 2015: China, which is already the world’s largest solar market, is set to more than quadruple its current capacity by 2020, a senior government official was quoted saying in the official state news agency. The director of new energy for China’s National Energy Administration told the Xinhua news agency that the government’s goal is to boost photovoltaic solar output by 20 gigawatts annually from 2016 to 2020, bringing the country’s total capacity to nearly 150 GW. China had 35.8 GW installed as of July.

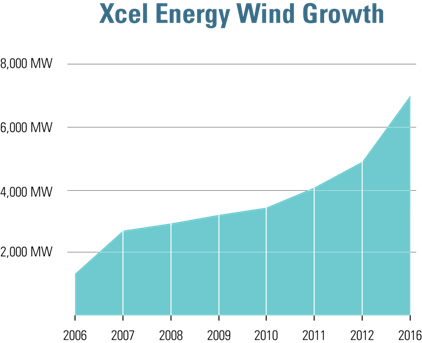

Xcel CEO says wind power now cheaper than natural gas

October 2015: The head of the biggest utility provider of wind energy in the U.S. said his company anticipates long-term contracts for wind power to beat out natural gas in costs. Minneapolis-based Xcel, which serves customers in eight states and often has wind providing as much as 60% of its electricity, is getting bids from contractors offering 20-year power purchase agreements at about $25 a megawatt-hour for wind. Even with natural gas prices close to historic lows, CEO Ben Fowke told Bloomberg News that Xcel expects prices for electricity from gas to average closer to $32 a MWh over the same period. “When we’re buying wind at $25, it’s a hedge against natural gas,” he said, adding that with plans to continue adding significant amounts of wind to the Xcel system, the utility is “going to be able to retire coal plants earlier than we expected.”

Aspen becomes 3rd U.S. city to get all its power from renewables

September 2015: After a decade of work, the city of Aspen, Colo., is now receiving all of its power for municipal buildings and operations from renewable energy sources. Aspen’s Utilities and Environmental Initiatives Director told the Aspen Times that even though just under 7,000 residents live in the city year-round the achievement was symbolically important because it “demonstrated that it is possible. Realistically, we hope we can inspire others to achieve these higher goals.” According to Climate Progress, Aspen is the third U.S. city to get 100% of its energy from renewables, joining Burlington, Vt. and Greensburg, Kans.

Solar project + battery storage will meet evening load in Hawaii

September 2015: As part of efforts to continue combatting Hawaii’s highest-in-the-country electricity prices, the utility serving the island of Kauai is expanding its solar capacity with battery storage in order to cut costs with less expensive clean energy. The Kauai Island Utility Cooperative has signed a contract to buy power from a 17-megawatt solar PV project being built on the island. The project includes a 52-megawatt-hour battery storage system that will be used to feed up to 13 MW of electricity onto the grid to reduce the evening peak load from 5-10 p.m. KIUC will buy power at 14.5 cents per kilowatt-hour, more than 30% less expensive than the oil-based electricity typically need at night, which costs 22 cents per KWh.

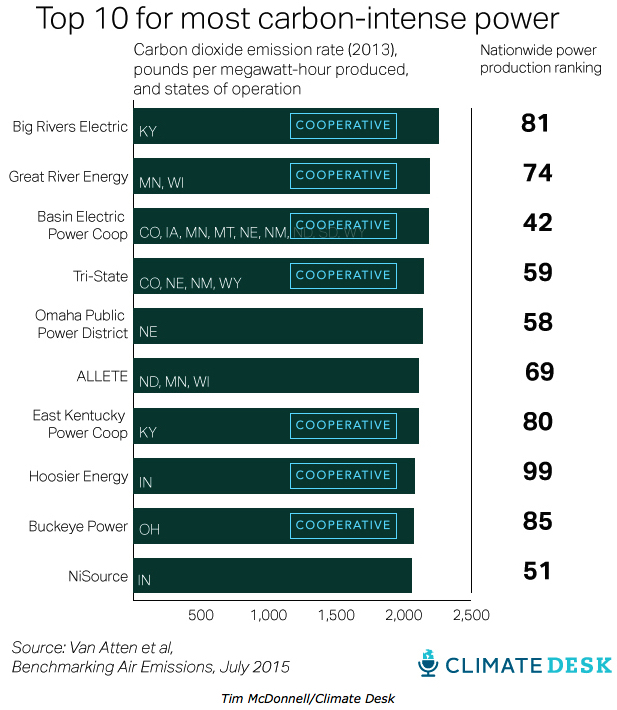

FERC ruling opens door to more clean energy development by co-ops

September 2015: A recent ruling by the Federal Energy Regulatory Commission may have removed one of the biggest obstacles to more clean energy development by rural electric cooperatives, which have lagged behind regulated utilities and remain one of the most coal-dependent energy providers in the utility sector. A Colorado co-op, Delta Montrose Electric Association, appealed to FERC to settle a dispute over its desire to buy clean power from a small local hydro-electricity producer. DMEA was stymied in its efforts by its “all requirements contract” with Tri-State Generation and Transmission Association, which generates a majority of the power it sells DMEA from coal. FERC ruled that the Public Utilities Regulatory Policy Act of 1978 supersedes contracts. Under federal law, power providers are obligated to buy power generated by “qualifying facilities.” The ruling doesn’t allow co-ops to develop their own clean energy resources beyond contractual limits, but it does open the door to outside clean energy developers getting around a big obstacle to sell their power to willing co-ops.

2015 shaping up as another record-breaker as PV hits 20 GW milestone

September 2015: The U.S. solar market remains on pace for yet another record-breaking year, with a strong second quarter and expectations for the last six months of 2015 to be significantly larger, according to a market analysis by GTM Research and the Solar Energy Industries Association. Overall, 1,393 megawatts of solar PV were installed in Q2 2015, the seventh consecutive quarter in which the nation added more than 1 gigawatt of PV panels. The second quarter also marked the milestone of cumulative installations eclipsing the 20 GW mark. During the first half of 2015, 40% of all new electric generating capacity brought on-line in the U.S. came from solar.

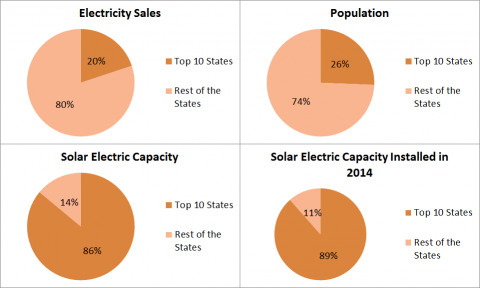

Top 10 states are driving America’s solar growth in a big way

September 2015: A new report shows that America’s Top 10 states in solar energy have driven huge gains in the past three years. The nation’s rooftop solar PV capacity has tripled in the past three years as the cost of solar energy has fallen rapidly, according to “Lighting the Way,” a report by by Environment America, and the top 10 states have led the charge, now accounting for 86% of the nation’s total installed solar electricity capacity. The top 10 states are: Arizona, California, Colorado, Hawaii, Massachusetts, Nevada, New Jersey, New Mexico, North Carolina and Vermont. California has the most rooftop solar installed, but Hawaii has surpassed Arizona as the state with the most solar capacity per capita.

“Remarkable” job growth boosts R.I. clean energy employment to 10,000

September 2015: A new report by officials in Rhode Island says there are now nearly 10,000 clean energy jobs in the state. The state’s Office of Energy Resources and the Executive Office of Commerce said the clean energy sector added 613 jobs over the last 12 months, bringing the total to 9,832. The agencies also projected that another 1,600 positions in energy efficiency, renewable energy and related fields would be created over the next year. Job growth in clean energy hit 6.6% over the past year, a “remarkable” surge for such a new sector, said a separate report, that easily outpaced Rhode Island’s overall rate of less than 1%. a separate report found. The majority of new clean energy jobs — about 52.5% — are in energy efficiency, which includes retrofitting buildings. Another 11% were in renewable energy, including installation and construction jobs.

DOE Sec. Moniz: renewables are cost-competitive, even without subsidies

September 2015: Speaking to reporters, U.S. Energy Secretary Ernest Moniz said that while the administration supports the extension of renewable energy tax credits, he sees solar continuing to grow even without subsidies because the value proposition is so favorable. Moniz cited data projecting that the cost of electricity from rooftop solar panels will soon fall as low as 6 cents per kilowatt-hour, making it “extremely competitive” with natural gas and other fossil and non-fossil power plants.

Calif. county’s switch to solar is saving taxpayers big on energy costs

September 2015: With the installation of a second solar project on county buildings in Yuba County, Calif., officials expect have all of the county’s facilities powered by renewable energy, and to be saving money. The county is spending $5.2 million to install 1.6 kilowatts of solar at the county airport but anticipates saving $16 million in energy costs over the next 30 years. A similar county solar project installed in 2011 at a cost of $10 million 2011 project helped cut the county’s annual power costs from about $1 million to $500,000 in one year.

Michigan tea party legislator pushing for clean energy incentives, growth

August 2015: Michigan State Rep. Gary Glenn, a first-term tea party Republican, says he wants to boost solar energy growth in the state through market incentives to increase competition and consumer choice. In an interview with Midwest Energy News, Glenn, the majority vice chair of the House Energy Policy Committee, said he is preparing a package of “competition-driven, free-market and incentive-based” bills to encourage distributed generation and allow ratepayers to buy renewable energy from alternative suppliers. “The fact that there’s not more solar is not because there are more cloudy days in Michigan than other states,” he said. “We have the least incentivizing policy in the country. … I don’t believe in mandating any form of energy, but we should be incentivizing solar as much as possible.”

Former Duke Energy CEO: Light the world with clean energy, not coal

August 2015: Former Duke Energy Jim Rogers, whose career made him responsible for tens of billions of dollars in centralized coal- and gas-fired generating capacity, is now pushing clean energy as a solution for energy poverty worldwide. In a new book, Rogers lays out his vision for bringing electricity to 1.2 billion people in the world who live without it. Lighting the World calls for governments, financial institutions and entrepreneurs to support small-scale, local clean energy projects such as rooftop solar in remote areas in Africa and other regions. “We can’t bring electricity to the rural areas of the world using an old-fashioned industrial grid based on building more coal plants and running copper lines from timber pole to timber pole across Sub-Saharan Africa, or running cables underwater to connect the archipelago of Indonesia,” Rogers wrote in the book. “The environment and financial impediments make that impossible.”

After a brief roadbump, utility-scale solar is again setting records

August 2015: After a slowdown in the growth of utility-scale solar in 2013 and early 2014, the sector has bounced back impressively, reports GreenTech Media’s Stephen Lacey. In the latter half of 2014, utilities around the country signed an unprecedented number of contracts for utility-scale PV projects, in large part because the technology had gotten so cheap. That momentum continues, with utility-scale solar hitting both cost and generation records. In June, for example, Austin Energy revealed that the average bid from developers in the second round of a 600-megawatt procurement averaged below 4 cents per kilowatt-hour. And in March, California became the first state to generate 5% of its electricity from utility-scale solar. Nationwide, the amount of electricity generated by utility-scale solar is 31 times higher than it was just a decade ago.

Utility exec: clean energy is the only way to electrify the third world

August 2015: The former CEO of America’s largest electric utility says the only feasible way to bring electricity to places like Africa where millions still live without it is by developing local, small-scale connections to distributed clean energy sources such as solar and wind. In a new book, Duke Energy’s Jim Rogers said constructing large centralized facilities like coal, gas and nuclear plants won’t work. “We can’t bring electricity to the rural areas of the world using an old-fashioned industrial grid based on building more coal plants and running copper lines from timber pole to timber pole across Sub-Saharan Africa, or running cables underwater to connect the archipelago of Indonesia,” Rogers writes. “The environment and financial impediments make that impossible. Instead, we’ll do it with modern technology: solar and other clean energy sources, new kinds of batteries, LED lights, efficient cook stoves and TVs, and plenty of innovations that now are surfacing.”

Global solar capacity to grow at compound rate through 2020

August 2015: The amount of solar PV capacity installed worldwide will grow at a compound rate of nearly 20%, more than doubling to at least 480 GW by 2020, according to projections in a report by consulting firm Hexa Research. At the end of 2014, global solar capacity totaled about 178 GW. Until now, growth in solar has been driven by developed countries but in the future, a majority of demand will come from rapidly developing Asia Pacific markets like China, India and Taiwan, the report said.

Federal court rejects challenge to Colo. renewable energy standard

July 2015: The 10th Circuit Court of Appeals in Denver has ruled that Colorado’s renewable portfolio standard does not harm interstate commerce and is therefore legal. The RPS, which requires Colorado’s biggest utilities to get 30% of their power from clean energy, was challenged in federal court in 2011 by legal institute connected to the coal industry. The 10th Circuit’s three-judge panel disagreed, saying in their opinion that Colorado’s renewable energy requirement “isn’t a price-control statute, it doesn’t link prices paid in Colorado with those paid out of state, and it does not discriminate against out-of-staters.”

HP to commits to powering Texas data centers with wind energy

July 2015: Hewlett-Packard has signed a 12-year contract to buy 112 megawatts of power from a wind farm in Texas, the latest in a growing trend of nontraditional companies turning to clean energy. In February, Kaiser Permanente announced a 20-year contract to buy 153 MW of wind and solar power in California. A month later, Dow Chemical said it would buy 200 MW of wind power in Texas. And earlier this month, Amazon Web Services said it would build and operate a 208-MW wind farm in North Carolina. The HP deal will provide electricity equivalent to that used by 42,600 homes and will be sufficient to fully power the company?s data centers in Texas.

Once a laggard, Alabama now looking for 500 MW of new clean energy

July 2015: Alabama’s largest utility has asked regulators for permission to install up to 500 megawatts of solar and other renewable energy projects, a substantial change in direction in a state dominated by coal and lagging behind others in clean energy development. Alabama Power, which still needs approval from the Alabama Public Service Commission, will focus on projects up to 80 MW to serve large companies, not residential customers. A company spokesman said no additional costs would be passed on to customers as part of the project. Once built out, the 500 MW will account for 4-5% of Alabama Power’s total capacity.

Wind power growth in first half of year doubles that of 2014

July 2015: With 1,661 megawatts of new wind turbine capacity coming online during the second quarter of 2015 and more than 13,600 MW under construction, wind power growth in the U.S. is at near-record levels. The American Wind Energy Association’s Second Quarter Market Report shows that 1,994 MW were installed during the first half of 2015, more than doubling installations from same period in 2014 but still below the record growth of 2012, when more than 2,900 MW was installed in the first half of the year. One of the most notable trends so far this year, AWEA noted, is the growing interest by Southeastern states in building and purchasing wind power, including announcement for new projects in Florida and North Carolina, the latter’s first venture into utility-scale wind. Looking forward, more than 100 wind projects are under construction in 24 states, representing more than 13,600 MW of total wind capacity and over $20 billion worth of private investment.

U.S. backs wind and solar projects in Jamaica to boost energy security

July 2015: As part of an effort to beef up energy security, U.S. interests are funding the construction of a 20 MW solar plant in Jamaica, The $60 million project, which will create 400 construction jobs and another 20 long-term operations jobs, is expected to cut Jamaica’s use of imported fuel oil by 3 million gallons a year. It is being funded by the federal Overseas Private Investment Corp., which also is bankrolling construction of a new wind farm in Jamaica. “We do not intend to forever remain hostage to imported fossil fuel and all the challenges that it brings,” Jamaican Prime Minister Portia Simpson Miller said.

Study says power bills in VA could fall thanks to new federal rules

July 2015: Implementing the Clean Power Plan in Virginia could result in lower electricity bills that save customers in the state up to $145 a year, according to a new analysis. In contrast to alarmist projections for cost increases made by Dominion Power, the report by the group Public Citizen group indicates that power bills could drop about 8% if state lawmakers focus on energy efficiency for Virginia’s implementation of the Clean Power Plan. The state has efficiency goals, the group said, and broadening them would result in lower bills for most households even if electricity rates rise slightly.

Japanese telecom giant commits $20 billion to solar projects in India

June 2015: Japanese telecom giant Softbank has committed to investing around $20 billion in solar projects in India through a partnership with Indian and Taiwanese enterprises. Coal currently dominates India’s energy mix, but the Indian government has set a goal of expanding the country’s solar output 33-fold to 100 gigawatts by 2022.

National clean energy job growth doubles rate from first quarter 2014

June 2015: Nationwide, more than 9,800 clean energy and clean transportation jobs were created during the first three months of 2015, according to data compiled by the nonpartisan business group Environmental Entrepreneurs. The growth is almost double the number of jobs E2 tracked in the same quarter of 2014. The top three states for job growth in the clean energy sector were: Georgia (2,870 jobs), California (1,885) and Texas (1,612). Nationally, solar was the top sector in Q1, with more than 6,600 new jobs announced.

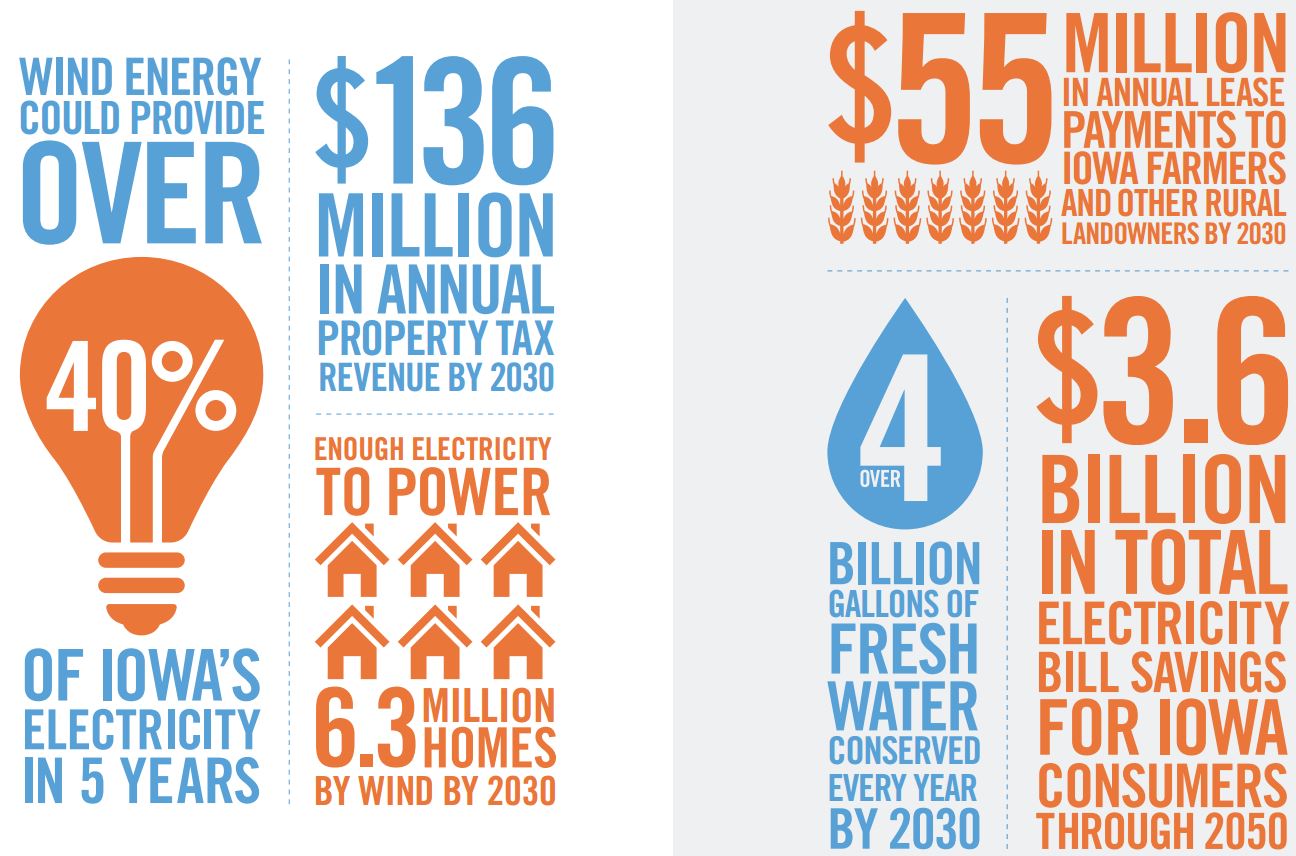

The sky is the limit for wind energy jobs and economic impact in Iowa

June 2015: Iowans could save $3.6 billion on their electricity bills over the next 35 years if the state expands its already healthy wind capacity, according to a new report by the American Wind Energy Association and the Wind Energy Foundation. Iowa already gets more than 28% of its electricity from wind, U.S. Department of Energy data show, which supports around 7,000 well-paying jobs. By 2020, wind could supply more than 40% percent of Iowa’s electricity, generating $49 million in annual property tax revenue and more than $19 million a year in lease payments to farmers and rural Iowa landowners. “In Iowa, we understand that an investment in wind power is an investment in jobs,” U.S. Rep. David Young (R) commented regard the report.

Residential solar installations in Q1 2015 shatter previous record

June 2015: Over the first quarter of 2015, the U.S. residential solar market grew 76% over the same period a year earlier, shattering installation records. Nationwide, companies installed 437 MW of rooftop solar PV in the first three months of 2015 – a total of 66,440 new home rooftop systems – according to a market report from the Solar Energy Industries Association. Little slowed the growth, including one of the worst winters in the Northeast’s history, yet the residential solar market had its biggest quarter of all time. During the quarter, solar accounted for 51% of all new electric generating capacity. The average cost for a residential solar system also fell to $3.48/watt, a 10% decrease from 2014.

Solar shines bright on Golden State

June 2015: With solar continuing to sprout up all across the state, California would rank sixth in the world in installed solar capacity if it were a nation, says Rhone Resch, president and CEO of the Solar Energy Industries Association. In a column in RenewableEnergyWorld.com, Resch pointed to SEIA’s Q1 solar market report showing that California has more solar assets than the United Kingdom, France, Spain, Australia and Belgium, and is the first state in the U.S. to top 10,000 megawatts of installed solar capacity — enough to power nearly 2.6 million homes. To that in perspective, the state has 10 times more installed solar capacity today than the ENTIRE U.S. had in 2007.

Investors commit $4 billion to Obama clean energy investment initiative

June 2015: Far surpassing expectations, philanthropic groups, pension funds and other institutional investors have committed $4 billion toward a White House initiative to shift the world to a low-carbon economy. The investments, announced at a White House clean energy investment summit, double the goal of $2 billion that the Obama Administration set out earlier this year and will be invested in projects such as technological fixes to cut carbon. As part of the summit, the White House also announced a series of related executive actions to drive additional private-sector investment in solar, wind and other clean energy technologies.

Savings are so great, Iowa school district goes completely solar

May 2015: Wind is usually what grabs the clean energy headlines in Iowa, but a school district in the southern part of the state is about to be completely powered by solar. In January, the WACO district installed an array of PV panels at an elementary school in Crawfordsville, which the district’s superintendent has saved about $20,000 in power costs this year alone. This summer, workers will add another set of panels to the junior-senior high building in Wayland, which will provide enough electricity to power more than 90% percent of the district’s needs.

Clean energy a huge job creator in IL

May 2015: According to a new comprehensive report, Illinois has added more than 7,500 clean energy jobs in the past 15 months. The Clean Jobs Illinois Report documented 104,449 clean energy jobs in the state – those connected with electric or alternative transportation fuels, greenhouse gas management, energy efficiency, wind power, geothermal, or solar power – up from just under 97,000 in late 2013.

Buffett antes up again on Iowa wind with new $900 million investment

May 2015: Warren Buffett’s MidAmerican Energy has committed to spending $900 million on 552 MW of new wind energy projects in Iowa over the next two years, bringing the utility’s total wind assets in the state to $6.7 billion. Once built by the end of 2016, wind will supply a projected 57% of Mid-American’s retail energy demand. Republican Gov. Terry Branstad said because of Iowa’s “low electricity prices and commitment to renewable energy, major tech companies and other energy-intensive businesses are interested in locating and expanding facilities here.” Google, Facebook and Microsoft have sited large data centers in Iowa as a result of its affordable clean energy. A company spokesman said wind energy also reduces MidAmerican’s reliance on coal, which protects customers from rising costs tied to stricter environmental standards, including carbon limits.

Hawaii is on track to get 100% of its electricity from renewables

May 2015: Under a bill passed last week by the Hawaii legislature, Hawaii could become the first state to get all of its electricity from renewable energy sources. If Gov. David Ige signs the measure into law – he has until the end of June – Hawaii would have the most ambitious energy goals of any state, aiming to convert to 100% renewable energy by 2045. Hawaii has no fossil fuel reserves and must import coal and oil for power generation, leaving residents paying some of the highest rates in the country.

AWEA: 2014 brought records for wind capacity and jobs

April 2015: Buoyed by the 2014 extension of the production tax credit on wind turbines, the U.S. enjoyed a revived “wind rush” in 2014, with records for output and jobs and according to the Annual Market Report from the American Wind Energy Association. The U.S. wind industry added 23,000 jobs in 2014, boosting the sector’s total to 73,000 jobs. Of those, 20,000 are manufacturing jobs at more than 500 facilities across 43 states. Four times more new wind generating capacity came online in 2014 than the previous year, and 2015 began with 12,700 MW of wind projects under construction, a record for the start of any year. Wind generation in the U.S. has more than tripled since 2008, providing 4.4% of the nation’s electricity in 2014.

Renewables buildout: “an order of magnitude larger” than coal & gas

April 2015: The world has passed a turning point in the development of clean energy and is now adding more renewable capacity each year than coal, natural gas and oil combined. And, says Bloomberg New Energy Finance’s founder, there’s no going back; “The question is no longer if the world will transition to cleaner energy, but how long it will take” writes Tom Randall. In 2013, renewables added 143 gigawatts of new capacity globally, compared with 141 gigawatts in new plants that burn fossil fuels, according to a BNEF analysis. “The electricity system is shifting to clean,” BNEF’s Michael Liebreich said in a keynote address at a BNEF summit. “Despite the change in oil and gas prices there is going to be a substantial buildout of renewable energy that is likely to be an order of magnitude larger than the buildout of coal and gas.”

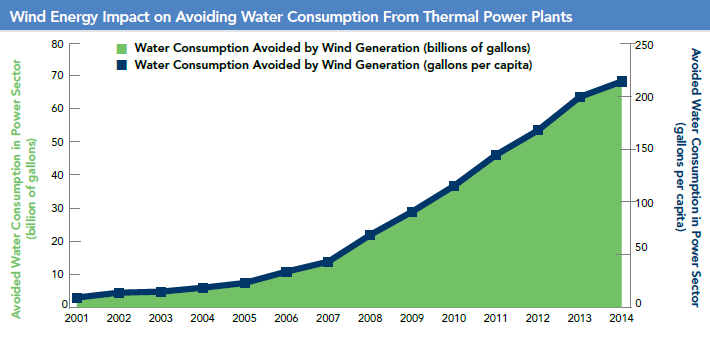

Wind saves the equivalent of 215 gallons of water for every American

April 2015: Wind energy avoided the consumption of more than 68 billion gallons of water in the United States in 2014, according to data from the American Wind Energy Association. The savings were equivalent to conserving roughly 215 gallons per person in the U.S. or 517 billion bottles of water. In drought-ravaged California, wind energy saved 2.5 billion gallons of freshwater in 2014, while Texas led the nation with savings of 13 billion gallons of water.

White House initiative aims to train 75,000 new solar workers by 2020

April 2015: President Obama has announced an initiative aimed at helping cut carbon emissions by boosting support for the solar industry. The goal of the initiative, which will be run through the Department of Energy, is to train 75,000 solar workers by 2020. It also includes as a component a Solar Ready Vets program that will utilize the GI Bill to train military veterans for the solar workforce at 10 U.S. military bases.

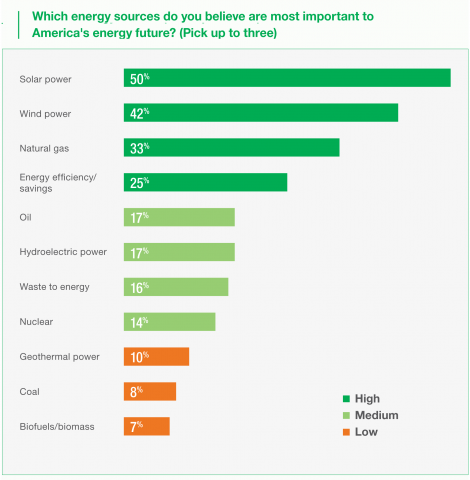

Americans unified in overwhelming support for clean energy

April 2015: In a national survey, American homeowners are overwhelmingly unified in their support of clean energy. The poll, conducted for Clean Edge and SolarCity, found that 87% of Americans believe renewable energy is important to the country’s future. Solar was the top choice when respondents were asked which energy sources are most important to the nation’s future, followed by wind, natural gas and energy efficiency. Coal and biomass received the least support. The support for clean energy crosses geographic, political and social boundaries. Solar power, for example, was the top choice among most of the demographic groups in our survey, including Republicans, Democrats, Independents, conservatives, liberals, city and rural dwellers, youth, and the elderly, as noted in a column by Clean Edge’s Ron Pernick in Renewable Energy World.

Record growth projected this year for offshore wind installations

April 2015: Analysts expect developers to install a record 4.2 gigawatts of offshore turbines in 2015, according to Bloomberg New Energy Finance, doubling the 2.1 gigawatts added in 2013. Germany is expected to lead offshore installations, accounting for more than half the total. Some of the new capacity results from delays in projects last year that will be completed this year, but offshore technology is also maturing, BNEF told Renewable Energy World in an interview. Worldwide offshore wind power is expected to reach 48 gigawatts by 2020. “Offshore wind installation is increasing year-on-year until at least 2020. There’s increased confidence that the technology is working and the cost of the technology is coming down,” a BNEF analyst said.

Rural electric co-ops capturing the benefits of locally generated solar

April 2015: Three rural electric cooperatives are among the national leaders in providing solar power, according to rankings compiled by the Solar Electric Power Association. Co-ops in Iowa, Tennessee and Utah ranked in the top 10 for solar watts per customer, SEPA reported in its annual snapshot. Solar is attractive to rural electric co-ops for a number of reasons, but locally generated energy is one of the main ones. “Solar power is helping us keep our members’ dollars local,” said Warren McKenna, CEO and general manager of Farmers Electric Cooperative in Kalona, Iowa, which ranked second nationally and meets 20% of its demand with solar and wind.

Energy Star competition showcases $50 million in energy cost savings

April 2015: Collectively, competitors in the EPA’s fifth-annual Energy Star Battle of the Buildings saved more than $50 million in energy costs by instituting programs that cut energy use last year by the equivalent annual energy use of more than 37,000 homes. One hundred teams entered more than 5,500 individual buildings in the competition, and together they reduced energy use by an average of 6%, or nearly $20,000 per building. The winner, a team from the small town of Woodville, Ala., cut average energy use in five buildings by 25%, freeing up $2,000 for street improvements and other town services.

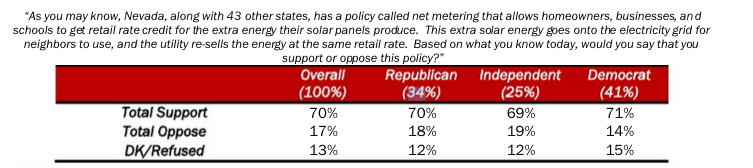

Poll finds strong support for solar, net metering policy in Nevada

April 2015: By substantial margins, Nevada voters support solar energy and a proposal to raise the limit on the amount of solar that homeowners, businesses and schools are paid for. Of the 300 likely voters surveyed in the poll, which was paid for by a consortium of solar companies, 84% said have a favorable impression of solar, and 70% said they support the net metering policy. Solar developers are pushing the Legislature to raise the cap on net metering from 3% to as much as 6%, saying the policy helps create jobs and compensate solar customers for the energy they contribute to the grid. NV Energy, the state’s biggest utility, is fighting the proposal.

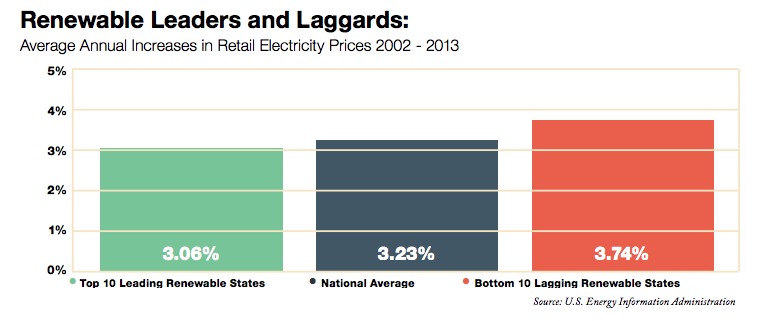

Study: Top 10 renewable states saw lower energy costs than bottom 10

March 2015: A new analysis shows that in the top 10 states with the greatest share of renewable energy, average retail electricity prices are on par with or slightly cheaper than the 10 states with the smallest share. The study by clean energy fund managers DBL Investors did not draw a direct correlation between renewables and electricity prices, but rather showed that leading clean energy states leading have not experienced disproportionate price growth, as some critics imply, the authors said. In their analysis, the top 10 renewable states had an average increase in retail electricity prices of 3.06% between 2002 and 2013. The bottom 10 states had a 3.74% increase. “The cost curves are coming down for renewables. And they will continue to come down as markets grow and technologies achieve economies of scale. It is a virtuous cycle,” one of the authors told The Denver Post.

Gallup poll: Americans favor clean energy over coal by wide margin

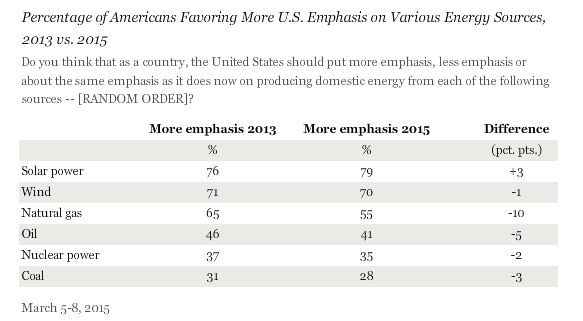

March 2015: A new Gallup poll shows that Americans overwhelmingly support the country putting more emphasis on developing renewable energy. Gallup interviewed a sample of 1,025 random adults from all 50 states and the District of Columbia in early March, and the results show solar power as the most popular energy source, with 79% of Americans saying the want more emphasis on producing energy from the sun. Wind was the second most favorable energy source. Only 28% of the respondents said they want more emphasis on coal. In a blog post on the results, Greenpeace’s Joe Smyth noted that the numbers reflect that “the coal industry’s PR campaign to attack clean air and climate change policies as a ‘war on coal’ has mostly failed.”

Dow Chemical signs wind contract as hedge against price volatility

March 2015: Dow Chemical has signed a long-term agreement to supply one of its plants in Texas with 200 MW of wind energy from a project being built nearby, which according to the company is the first time in the U.S. that wind has been used to power a large-scale manufacturing facility. The wind power acquisition makes Dow the third largest corporate purchaser of wind energy in the U.S. “Adding large scale renewable energy to Dow’s manufacturing process is just one smart move that we can make to secure a future of sustainability, growth, and long-term competitive advantage,” Seth Roberts, Dow’s global business director of the Energy and Climate Change, was quoted saying in FierceEnergy. “This decision also serves as a systemic hedge against both energy and power price volatility, while improving our overall carbon footprint.”

Obama orders aggressive fed shift to renewables to cut CO2 emissions

March 2015: The Obama Administration has ordered all federal government agencies to reduce their CO2 emissions 40% below 2008 levels over the next 10 years by shifting to renewable energy. President Obama signed the executive order this month, building on a 2010 White House directive requiring 35 U.S. agencies to limit their energy consumption to help fight global warming, as reported in Renewable Energy World. The federal government is the largest energy consumer in the United States, and Obama said it is “important for us to lead by example … We’re proving that it is possible to grow our economy robustly while at the same time doing the right thing for our environment and tackling climate change in a serious way.”

In the heart of oil country, a Texas town opts for 100% renewable energy

March 2015: In a perspective piece in Time Magazine, the mayor of fast-growing Georgetown, Texas said his city’s decision to switch to 100% renewable energy was “a business decision based on cost and price stability.” Georgetown will fully convert to wind and solar power by 2017 as newly signed contracts kick in. Mayor Dale Ross said the switch made sense for a number of reasons. It will “provide wholesale electricity at a lower price than our previous contracts … that will enable the city to avoid the price volatility and regulatory costs we were likely to have seen had we continued to use electricity generated by burning fossil fuels.” He also said solar and wind will cut down on water use in a drought-plagued state, and that he expects the commitment to renewable energy to attract companies looking to achieve “sustainability goals at a competitive price.”

Clean energy tallies $1 billion-plus in savings for Fortune 500 companies

March 2015: Clean energy is becoming mainstream for Fortune 500 companies and those that invest in renewable energy and cutting their carbon emissions are saving more than $1 billion a year, according to a new study. Published Ceres, WWF, Calvert Investments and consultants David Gardiner & Associates, “Power Forward, How American Companies Are Setting Clean Energy Targets and Capturing Greater Business Value,” found that 43%, or 215 of the companies in the Fortune 500, have set targets to cut CO2 emissions, boost renewables or improve energy efficiency. Among the Fortune 100 companies, 53 report that their investments in on climate and energy projects are collectively saving $1.1 billion annually.

Target on target to boost solar at 180 of its locations nationwide

March 2015: Keeping step with rival retailer Wal-Mart, Target has announced that it will install large solar PV systems on the roofs of 180 stores and distribution centers in 12 states, about 10% of the company’s locations. On average, there will be 1,700 panels per site, with a combined output across all locations of 100 MW of electricity that will meet 20-30% of each facility’s demand. The panels will actually be installed and owned by Connecticut-based Greenskies Renewable Energy; Target will buy 100% of the electricity generated “at a fixed and sharply discounted rate for the length of the contract.” The projects are expected to be complete by the winter of 2016. Walmart solar PV systems on 250 of its U.S. stores.

California is 1st state to produce 5% of electricity from solar plants

March 2015: With a number of new large solar projects coming online – including including two 550 MW plants, the 377 MW Ivanpah project and a 250 MW plant – California has become the first state to get more than 5% of its electricity from utility-scale solar power. According to the U.S. Energy Information Administration, large-scale solar generated 9.9 million megawatt-hours of electricity in 2014, triple the amount from 2013. The data show that California’s solar production was more than all other states combined, and more than three times as much as Arizona, which came in second place for 2014.

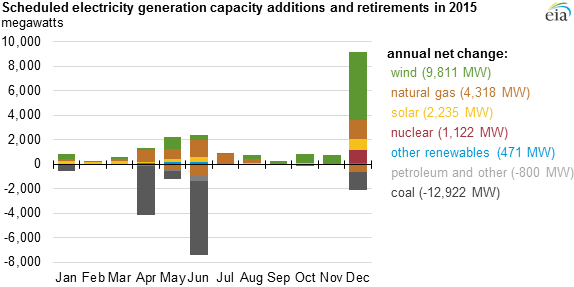

EIA: renewables, natural gas in, coal out for new capacity in 2015

March 2015: The latest projections compiled by the U.S. Energy Information Administration indicate in 2015, renewables and natural gas will make up the vast majority of new more than 20 GW of new generating capacity that utilities expect to add to the power grid. EIA data show that 9.8 GW of wind are in the pipeline to be switched on this year, 6.3 GW of natural gas, and 2.2 GW of solar. Together, they comprise 91% of total new capacity expected this year. Conversely, EIA data show nearly 16 GW of generating capacity on the drawing board to be retired this year, with 81% of the total (12.9 GW) coal-fired generation.

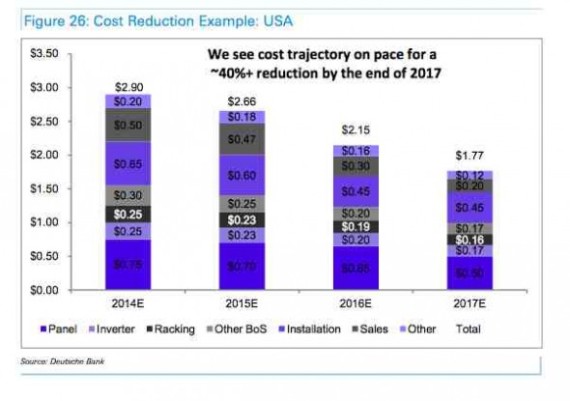

Analysts: grid parity will make solar the world’s leading energy source

March 2015: A new report by analysts at Deutsche Bank projects that solar will become the dominant electricity source globally over the next 15 years as prices continue to drop, displacing large amounts of fossil fuel. As reported in Renew Economy, the analysis says that by 2030, the solar market will increase ten-fold, adding more than 100 million new customers. Solar energy already costs the same or less than conventional fossil fuel-generated energy (grid parity) in more than half of all countries, and within two years, it will be at parity in around 80% of the countries worldwide. “Over the next 5-10 years, we expect new (solar) business models to generate a significant amount of economic and shareholder value,” the Deutsche Bank analysts wrote.

Wisconsin Lt. Gov. says renewables give others a “competitive advantage”

March 2015: In a radio interview on March 20, Wisconsin’s lieutenant governor acknowledged that states working to cut their carbon pollution and emphasizing the development of clean energy have a “competitive advantage” over states like Wisconsin that are fighting to maintain their reliance on coal. Republican Lt. Gov. Rebecca Kleefisch was criticizing the Obama administration’s proposed Clean Power Plan, which will sharply cut carbon pollution from power plants, when she said that Wisconsin’s refusal to move away from coal, which provides about 60% of the state’s electricity, hurt her state’s competitiveness. Neighboring states like Iowa and Minnesota have invested heavily in ramping up their wind and solar capacity.

Costa Rica has been completely fossil fuel-free so far in 2015

March 2015: For the first 75 days of 2015, Costa Rica got 100% of its energy from renewable sources, according to the state-run Costa Rican Electricity Institute. Hydroelectric power makes up the majority of the country’s renewables, and heavy rains have helped the country avoid using any fossil fuels at all so far this year. Fortuitously for residents, the boost to renewable capacity also has helped lower electricity rates by 12% percent. Costa Rica has a goal of becoming carbon-neutral by 2021.

The market for energy storage projects made big gains in U.S. in 2014

March 2015: The market for energy storage technology grew more than 40% in 2014 in the United States, according to a joint research partnership between GTM Research and the Energy Storage Association. Last year, 180 projects with the capacity to store 62 came on line, up from 44 megawatts from 2013. “The U.S. energy storage market is nascent but growing fast,” a GTM executive was quoted saying in Fierce Energy . “Attractive economics already exist across a broad array of applications, and system costs are in rapid decline. We expect some fits and starts, but significant overall growth for the market in 2015.”

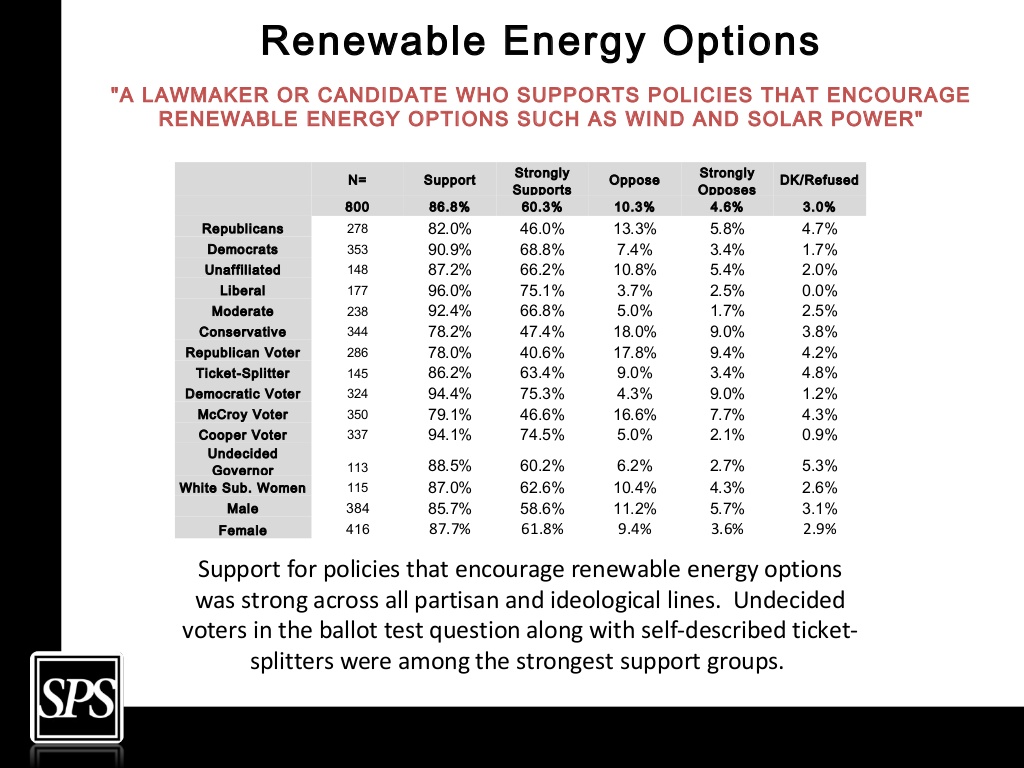

Poll shows overwhelmingly lopsided support for clean energy in NC

March 2015: A poll conducted by conservative clean energy advocates in North Carolina has found overwhelming support for solar, wind and energy efficiency in the state, regardless of party affiliation or ideology. In a survey of 800 North Carolina voters, the group Conservatives for Clean Energy found that 87% said they would support a candidate who favored policies that encourage renewable energy, including 82% of Republicans, 91% of Democrats and 87% of unaffiliated voters. Similarly lopsided support was seen for tax incentives for renewable energy and the state’s renewable energy standard.

2014 was the biggest year ever for new utility-scale solar projects

February 2015: Utility-scale solar had its best year ever in 2014, with the installation of more than 3.7 GW of new capacity from 109 projects, 10% higher than the 3.4 GW installed in 2013. In total, there are now 10.6 GW of utility-scale solar capacity operating in the U.S., according to SNL Energy Notable projects included the 280-MW Abengoa Mojave Solar, the largest built last year, and the 255-MW phase four of the Topaz Solar Farm, which brings the total capacity of the PV project to 567 MW, making it the largest solar farm in the world.

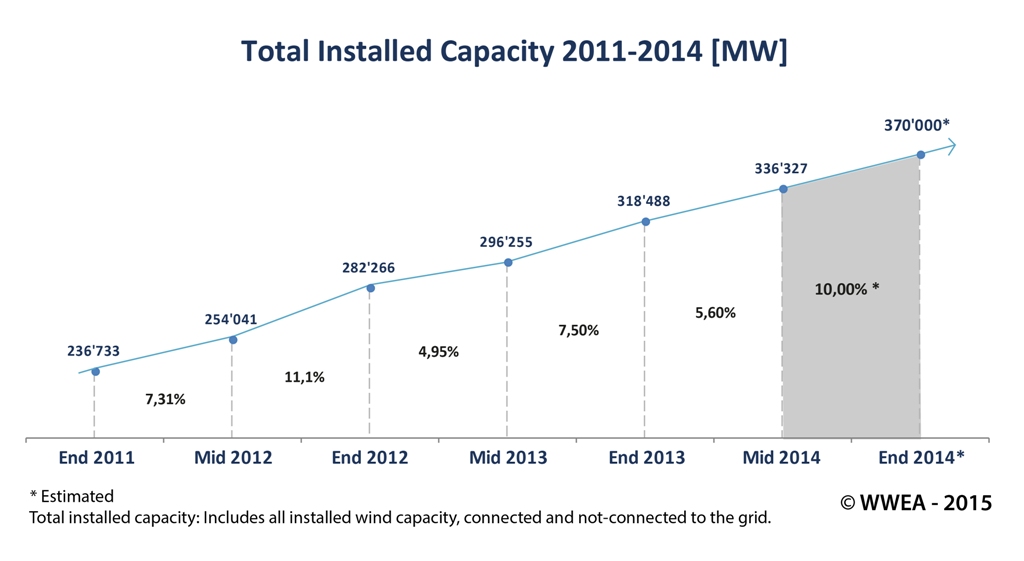

Countries setting records worldwide for new wind power installations

February 2015: There were a record number of wind turbine installations worldwide in 2014, according to data from the World Wind Energy Assocation. In all, more than 50 GW of capacity were added last year, bringing total global wind power capacity close to 370 GW. China led the pack, installing 23 GW on new wind in 2014, the largest amount a country has ever added in one year, followed by Germany and the U.S. Brazil joined the top five, the first time a South American country has cracked the top 10 in wind energy (a full list of leading wind countries is available here). Half of the top 12 countries set records for new capacity.

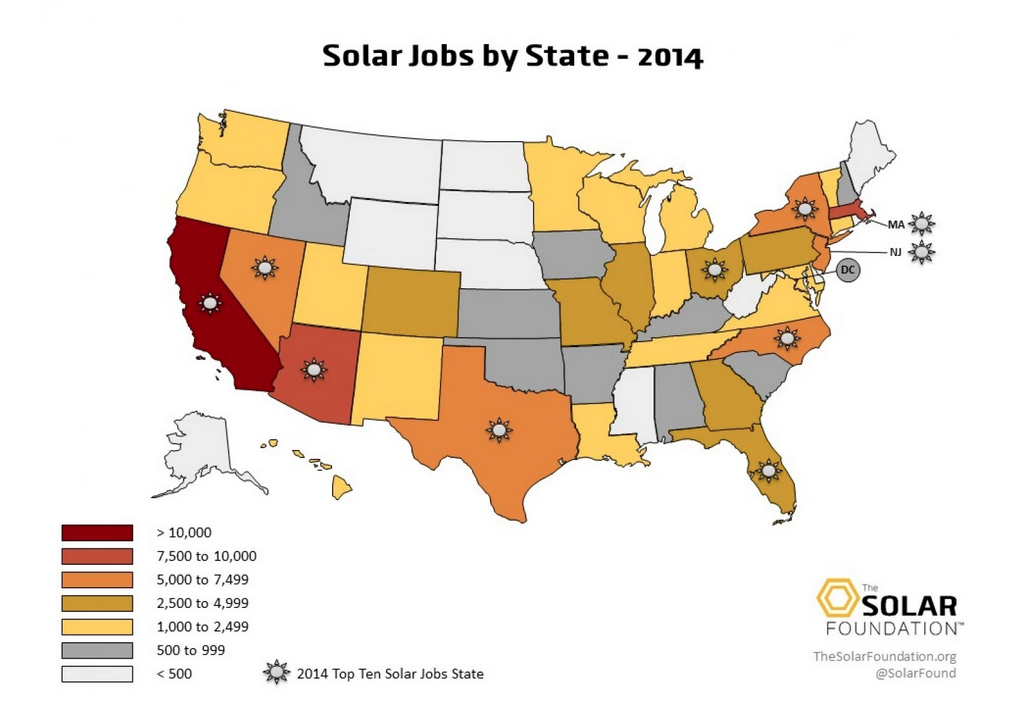

Red, blue, doesn’t matter. Solar job growth doesn’t pick political sides

February 2015: One of the upshots of solar job growth in the U.S., says Washington Post journalist @Chris Mooney, is that it’s “catching on in a lot of states that we don’t traditionally think of as being liberal, do-gooder territory.” While California and Massachusetts are the top solar job states, other leaders include conservative Arizona, Texas and Nevada –– for obvious reasons – but also North Carolina, Ohio and highly conservative Georgia, which saw a mind-boggling 261% increase in solar employment in just two years. A key reason for solar’s geographic and political diversity, says Mooney, is that solar “appeals to a libertarian style of thinking — you generate your own power, rather than being dependent upon some utility somewhere. It increases your independence, your economic liberty.”

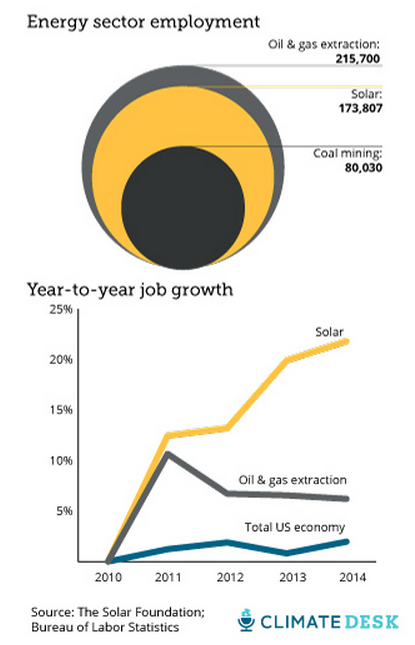

Solar job growth outpaces U.S. economy, leaves coal in the dust

February 2015: Jobs in the solar industry in the United States grew 10 times faster than the overall economy, according to The Solar Foundation’s 2014 State Job Census. As of November 2014, the solar industry employed 173,807 workers (in installation, manufacturing, sales and distribution), a 22% jump from the previous year. Notably, solar job growth is significantly outpacing the fossil fuel industry. Solar jobs now outnumber coal mining jobs 2-to-1 and are quickly catching up to jobs in oil and gas extraction, the report noted. The coasts are well represented, with California’s 54,700 jobs ranking number one and Massachusetts number two at 9,400 jobs.

Apple continues to lead the way on merging high-tech and clean energy

February 2015: In separate deals, Apple has cemented its leadership position on clean energy in the high-tech sector. In the U.S., Apple has signed the largest clean energy agreement ever for a commercial end-user. The computer giant will pay $848 million to buy 130 megawatts of power from First Solar’s 2,900-acre California Flats solar PV project for 25 years. Construction on the project is scheduled to be complete by the end of 2016. In Europe, Apple has announced a plan to build two data centers that will be powered 100% by renewable energy. One center will be built in Viborg, Denmark and be powered mainly by wind energy. The other, in County Galway, Ireland will be powered partly from biomass. Both data centers are expected to open by 2017.

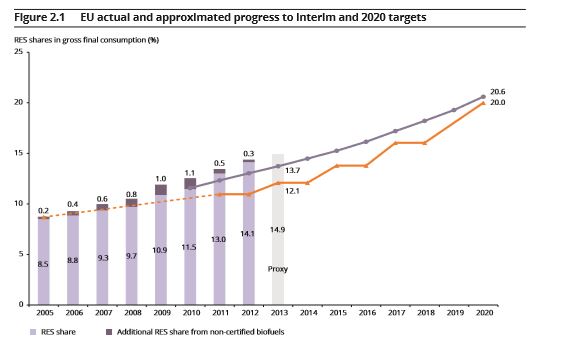

Europe on target for 20 percent renewable energy by 2020

February 2015: The European Union is on target to achieve its goal of 20% renewable energy by 2020, according to a report from the European Environment Agency, which analyzed data from 2013. Some nations, such as Britain, the Netherlands, and Luxembourg, are their targets with less than 5% energy from renewables, while Austria, Finland, Sweden and Latvia are all above 30%. Hydropower (42.6%) and onshore wind (26.2%) provided the majority of electricity from renewables, with percent and 26.2 percent, respectively. Beyond 2020, EU countries have agreed to a 27% renewable target by 2030 and 55-75% percent by 2050. “We can go even further: if we support innovation in this area [renewable energy] could become a major motor of Europe’s economy, bringing down emissions while creating jobs,” said EEA Executive Director Hans Bruyninckx.

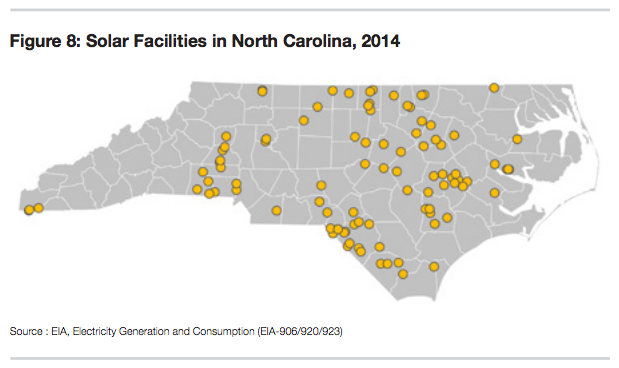

North Carolina’s solar leadership spreads profits across the state

February 2015: North Carolina’s continued investment in solar is paying handsome dividends, according to a new report by Duke University. “The Solar Economy: Widespread Benefits for North Carolina” credits business-friendly policies such as its renewable energy standard and a renewable tax credit with stimulating economic development. As a result, the state now has 150 solar facilities bigger than 1 megawatt and the industry employs 4,300 workers at 450 companies, representing more than $2 billion of investment. The benefits are being felt in all parts of the state and in both rural and urban areas. Paraphrasing one company executive they interviewed, Duke researchers said, “North Carolina is good for solar, but solar has also been very good for North Carolina.”

South Africa’s economy sees net profit from wind and solar projects

February 2015: South Africa’s renewable energy program helped save the country more than $450 million in energy costs in 2014, according to a recent study by the Council for Scientific and Industrial Research. The country’s 600 MW of wind and 1 GW of solar capacity was helped along by subsidies totaling $390 million, leaving a net ‘profit’ to the economy of around $60 million. Electricity generated from renewable projects replaced more than 2 terawatt-hours of electricity generated by diesel- and coal-fired power plants.

Washington state solar incentives pay for themselves ‘many times over’

February 2015: Data from a survey of solar installers and manufacturers in Washington state show that every dollar of incentives provided to owners of solar PV systems injected $2.46 back into the economy in 2013. Solar Washington collected the data to gain insight into the industry’s impact on Washington’s economy. For 2013, state incentives of $19.6 million resulted in $48.2M in economic impact, including $25.4 million in payroll and $21.5 million in equipment purchases from in-state suppliers. “Based on the data we’ve gathered, solar incentives in Washington State pay for themselves many times over and are a boon to the state economy,”said David Nicol, president of Solar Washington’s board.

Bloomberg: U.S. clearly on a path toward a clean energy future